Stillwater Critical Minerals Corp. (PGE:TSX.V; PGEZF:OTCQB; J0G:FSE) has reported the final drill results from resource expansion drilling at its flagship Stillwater West project in Montana last year.

The campaign was funded by an investment by major Glencore, which holds a 15.4% position in Stillwater and has provided ongoing technical support to the company, even adding Glencore Vice President Bradley Adamson to Stillwater's Board of Directors.

Stillwater released results from six holes totaling 2,310 meters that were focused on expanding deposits at the west end of the current 9-kilometer-long resource area.

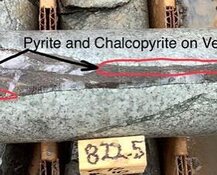

Holes CM2023-01, CM2023-02, and CM2023-03 targeted and successfully intercepted magmatic nickel and copper sulfide mineralization with significant platinum group element (PGE) mineralization, furthering known parallels with the Bushveld Igneous Complex, the largest layered igneous intrusion in the Earth's crust in South Africa.

"Our drill campaigns have successfully leveraged a substantial historic database to arrive at a total of approximately 40,000 meters of drilling in 236 holes to date," said Stillwater President and Chief Executive Officer Michael Rowley. "That wealth of data, combined with Glencore's backing and in-house expertise from similar geology in South Africa's Bushveld Igneous Complex, has positioned us exceptionally well with the largest nickel resource in an active American mining district at a time when the U.S. is looking to onshore supply chains of nine of the commodities we have inventoried."

Stillwater noted that drilling also successfully intercepted N-series mineralization in structures that are not known in the Bushveld Igneous Complex but have now been modeled in a series of eight north-south trending structures at Stillwater West.

These structures contain high-grade nickel sulfide mineralization that was first discovered in drill holes CM2020-04 and CM2021-05 and later re-interpreted. Multiple high-grade base and precious metals intervals were returned, including multigram PGE intercepts ranging up to 3.96 grams per tonne g/t platinum (Pt) and 2.84 g/t palladium (Pd) over 1.16 meters starting at 308.8 meters in hole CM2023-03, in addition to wider intervals such as 44.2 meters at 0.83 g/t 3E (Pd+Pt+gold, or Au) starting at 252.7 meters in hole CM2023-01.

The Catalyst: 'Significant Potential' to Upgrade MRE

The company said the results demonstrate significant potential to expand the 2023 Mineral Resource Estimate (MRE) for the project at three cut-off grades, with wide widths of higher-grade mineralization at >0.70% recovered nickel equivalent (NiEq) cut-off grade contained within thick mid-grade intervals at >0.35% NiEq cut-off that are in turn set within long lengths of potential bulk tonnage mineralization at >0.20% NiEq cut-off grade, including:

- Hole CM2023-01:

- Bulk tonnage: 347.3 meters at 0.20% NiEq (0 to 347.3 meters);

- Mid-grade: 44.2 meters at 0.43% NiEq (252.7 meters to 296.9 meters);

- High-grade: 3.2 meters at 0.95% NiEq (60.7 metersto 63.9 meters).

- CM2023-02:

- Bulk tonnage: 214.9 meters at 0.20% NiEq (28.4 meters to 243.2 meters);

- Mid-grade: 13.9 meters at 0.39% NiEq (184.6 meters to 198.4 meters);

- High-grade: 0.43 meters at 1.61% NiEq (71.6 meters to 72.1 meters).

- CM2023-03:

- Bulk tonnage: 386.8 meters at 0.20% NiEq (0 to 386.8 meters);

- Mid-grade: 11 meters at 0.44% NiEq (182.3 meters to 193.2 meters) and 14.6 meters at 0.44% NiEq (295.4 meters to 310.0 meters);

- High-grade: 3.66 meters at 0.78% NiEq (189.6 meters to 193.2 meters) and 3.05 meters at 0.78% NiEq (240.49 meters to 243.54 meters).

Stillwater said the results are driving the first ever detailed geological model completed across the lower Stillwater Igneous Complex, with the latest results further demonstrating three mineralization styles in particular: broad Platreef-style Ni-PGE-Cu-Co mineralization, nickel sulfide-rich N-series mineralization, and stratiform reef-type PGE-Ni-Cu chromitite mineralization.

"Results from the 2023 drill campaign demonstrate the accuracy of our developing model of the Stillwater Igneous Complex while providing essential data from areas that have never been drill tested previously," said Stillwater Vice President Exploration Dr. Danie Grobler. "Multiple highly mineralized intervals were encountered in which we continue to see strong parallels with the Bushveld Igneous Complex."

All deposits and mineralization remain open for expansion in planned follow-up drilling, the company noted.

Elements Important to Energy Transition

According to Mordor Intelligence, the nickel market is expected to grow by a compound annual growth rate (CAGR) of more than 4.8% from 2024 to 2029. The market was valued at more than 2.1 million tons in 2021, analysts said.

The driving force over the medium term will be the demand for nickel in stainless steel alloys, Mordor noted, as well as for automobile batteries and energy storage systems in wind turbines or solar panels needed for the energy transition.

An article from Stockhead on May 13 noted how Sprott's Steve Schoffstall spoke highly about nickel potential.

"In our view, nickel miners are poised to offer investment attractive opportunities to investors," Schoffstall said. "Although nickel prices declined in 2023 on the back of softer Chinese EV sales and a flood of supply from Indonesia, the metal has been rebounding thus far in 2024 and benefiting the prospects of mining companies.

Schoffstall added, "The rise in nickel prices seems to be a combination of investor sentiment, potential supply constraints, and the underlying long-term demand for nickel in the clean energy transition."

Geopolitics are very important when looking at global nickel supply, especially given Chinese dominance in nickel markets via mines and processing operations in Indonesia, Rowley told Streetwise Reports.

"For this reason, Stillwater highlights the importance of having the largest nickel resource in an active U.S. mining district," he said. "The Stillwater district has been a source of critical minerals for over 100 years, from the U.S. government's past subsidies for chromium production to ongoing production of critical minerals at Sibanye-Stillwater's adjacent mining complex."

According to Straits Research, PGE metals are utilized in various products, including oxygen sensors, fuel cells, auto catalysts, jewelry, electronic parts, and medical equipment, among other things.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Stillwater Critical Minerals (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE)

The global market for PGE was US$15.7 million in 2021 and is projected to reach US$21.8 million by 2030, growing at a compound annual growth rate (CAGR) of 4.44% from 2022 to 2030, researchers said.

Ownership and Share Structure

Management and insiders own approximately 20% of Stillwater, according to the company. Executive Chairman and Director Gregory Shawn Johnson owns 2.86%, President and CEO Michael Victor Rowley owns 2.56%, Independent Director Gregor John Hamilton owns 1.65%, Independent Director Gordon L. Toll owns 0.44%, and Vice President of Exploration Daniel F. Grobler owns 0.23%, according to Reuters.

Institutions own approximately 25% of the company, high net-worth investors own about 27%, and Glencore Canada Corp. owns 15.4%. About 18% of the company's shares are in retail, Stillwater said.

There are 197.79 million shares outstanding with 162.25 million free float traded shares, while the company has a market cap of CA$33.84 million and trades in a 52-week range of CA$0.13 and CA$0.23.

| Want to be the first to know about interesting Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stillwater Critical Minerals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Stillwater Critical Minerals Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.