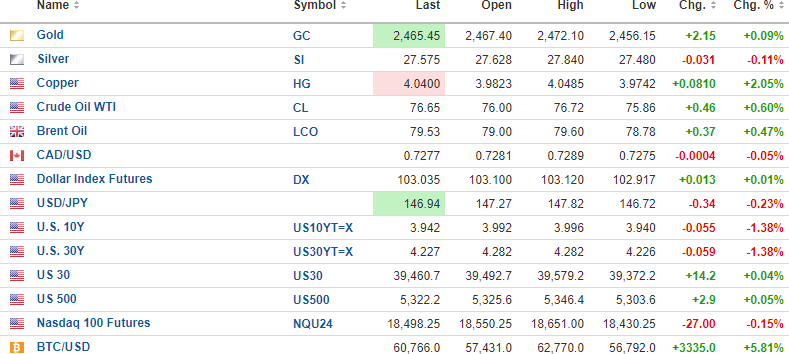

USD dollar index futures are very slightly higher (+0.01%) this morning with 10-yr. (-1.38%) and 30-yr. (-1.38%) bond yields lower.

Gold (+0.09%) and oil (+0.60%) and copper (+2.05%) are rallying while silver (-0.11%) is down.

Stock futures are mixed (-0.15% - +0.05%), with risk barometer Bitcoin (+5.81%) up sharply.

Copper for September delivery came down below $4.00/lb. on Monday and Wednesday, slipped back on Thursday, but is up nearly $0.08/lb. this morning to $4.03. I fully expect copper to rally from the deeply oversold conditions created earlier this week and make an attempt to get back above the 200-dma at $4.11/lb.

Nonetheless, that is still a far cry from the May 20 peak at $5.199/lb. at the height of the fever-pitch narrative screaming "structural shortage" being repeatedly rhymed off by cab drivers, shoeshine boys, and aspiring fintwit blogsters. One thing about the electrification metals is glaringly obvious; they are to be rented, not owned, because lithium, uranium, and copper have all now completed bull market phases lasting less than two years, all in the span of the post-pandemic period.

The metals being touted by the highly- esteemed Tavi Costa and echoed by the ever-bombastic Rick Rule is silver, but even that shiny little metal is one percentage point from entering a full-blown bear market, down 19.3% from its May top. The only metal that maintains its technical superiority is gold, and while it has been volatile, it bears nowhere near the volatility of the other metals, as can be seen from the chart below.

Unlike the next chart (copper), gold has been trending in classic textbook fashion for most of the year and definitely since the late October lows of 2023.

Copper, however, which has been one of my two top metal choices for "2024 and beyond," despite the enormously bullish fundamental narrative that has most certainly not disappeared, is in a technical bear market, down nearly 25% from it May peak and has knifed down through the 50, 100, and 200-dma levels.

I am not changing my stance toward the copper-gold baskets of securities led by copper-gold behemoth Freeport-McMoRan Inc. (FCX:NYSE) or junior explorer-developers like Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB), and Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE) because all of these names include gold as a resource or as a significant co-product of the targeted resource.

I am simply laying out the technical picture for copper and ignoring the fundamental bias that can get me into trouble. A great example of that was in mid-2023 when lithium was being touted as the "wonder metal" that would help the world transition away from ICE's and into EV's seamlessly while enriching the producers and all of their shareholders. That narrative has not changed, and global demand for lithium-ion batteries will indeed skyrocket as we approach the end of the decade — BUT — that has not stopped the price of lithium carbonate from plunging 85% in three years with U.S. lithium giant Albemarle Corp. (ALB:NYSE) crashing from over $330 to $80 in the same time span.

Do you remember when uranium was going to save the world from going dark by fueling all those new reactors currently in construction around the globe? Remember Rick Rule telling us that a $200/lb. price would certainly not surprise him? All of the above was in full chorus back in January when I was dumping a bunch of uranium names at or near the highs.

Similarly, the copper narrative was absolutely raging back in May, with Ivanhoe Mines Ltd.'s (IVN:TSX; IVPAF:OTCQX) boss Bob Friedland tweeting out copper-bullish content multiple times a day while being interviewed by everyone willing to listen to his eloquent pitch on copper's future meteoric rise that was surely going to see prices exceed $10/lb. by 2025. Agonizingly, I sold all of my beloved FCX and the June calls around the third week of May above $53 and then watched in terror as the stock price kept rising to peak eventually at $55.235 on May 20.

Well, fast forward three months. Has the copper narrative shifted? Not in the slightest, as copper demand continues to surge amidst persistently declining copper supply, but that has not been able to offset the overabundance of supply over demand when it comes to price elasticity because copper is now barely above $4.00/lb. and FCX, which is the world's foremost producer of copper and a substantial producer of gold, dropped 29% in the same period.

The point I make is that in today's world of trading and investing I have to let the technical analysis take precedence over fundamental analysis because by the time the fundamentals catch up to the technicals, it is always too late.

I replaced the Freeport-McMoRan positions on Friday of last week and Monday of this week and will probably trade them back out on a test of the 200-dma at $43.50.

| Want to be the first to know about interesting Gold, Base Metals, Critical Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., Fitzroy Minerals Inc., and Vortex Metals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Getchell Gold Corp., Fitzroy Minerals Inc., and Vortex Metals Inc. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.