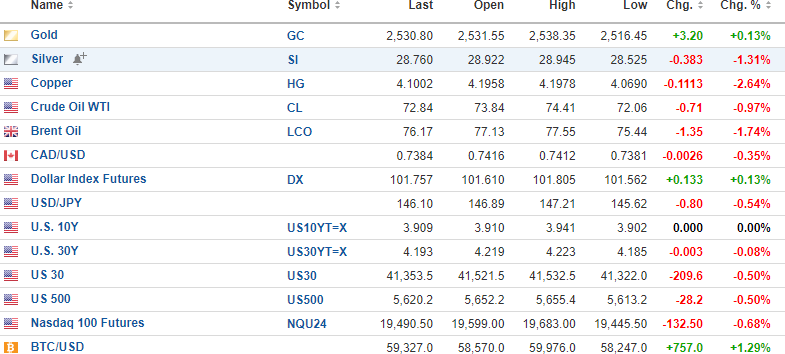

USD Index futures are up 0.133% this morning with 10-yr. yields flat and 30-yr. (+0.12%) yields slightly lower.

Gold (+0.13%) is up while silver (-1.31%) and copper (-2.64%) are lower.

Oil is down 0.97%. Stocks are headed lower while risk barometer Bitcoin is down 1.34% to $59,666.

Stocks

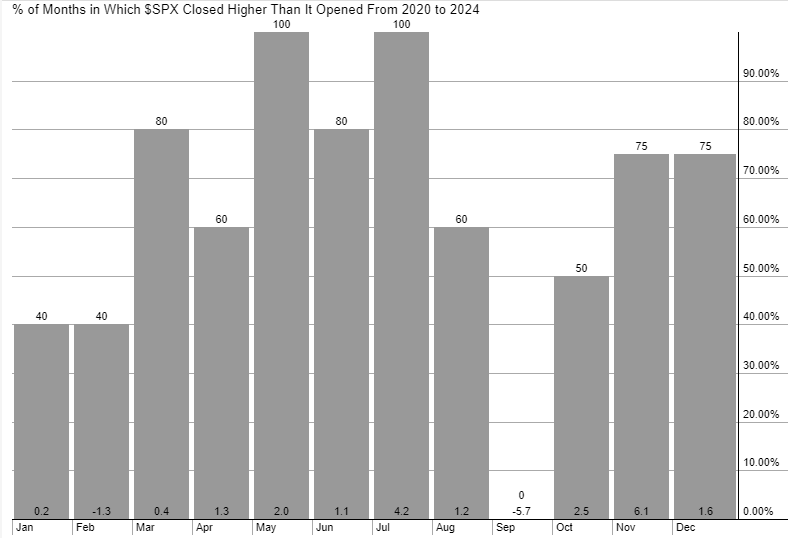

We have now entered the weakest month of the trading year and in another couple of days, the corporate buyback window slams shut. It is interesting to note that August 5 marked the "carry trade crash" low AND the re-opening of that same window.

From a positioning standpoint, the bigger funds are now back to being fully invested in stocks moving into the last month of the fiscal third quarter. Sentiment, as measured by the CNBC "FEAR-GREED Index," is back to <GREED> at 63 in direct contrast to the <FEAR> reading at 27 one month ago.

If contrarian investing is to be used as a trading tool, then I should be pleased with my volatility position looking out to the next few weeks.

Copper

Today, copper has opened down sharply which is disturbing but not exactly surprising as it is largely correlated with stocks most of the time (and vice-versa). Just as copper gets bludgeoned in the late-July-early-August sell-off, it will come under pressure again in September if stocks are going to lead the way lower.

Down $0.11/lb. is a hefty drop for a commodity that has been enjoying a decent recovery rally since the beginning of August where it bottomed at around $3.92/lb.

With that in mind, my Freeport-McMoRan Inc. (FCX:NYSE) position is called $1.53 lower, and while I have no concern for the shares I own, the November $40 and $45 calls, profitable as a package by $5,600 as of Friday's close, will open sharply lower this morning.

I am going to see where the calls open, and if I can break even on the two series, I will hold the shares but move to the sidelines with the call options, as September's track record is not good for holding short-dated calls.

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMoRan Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.