News that Asanko Gold has increased production guidance and secured positive drill results from a new exploration site at its Ghana mine project spurred positive comments from four analysts following the company.

Asanko Gold Inc.'s (AKG:NYSE.MKT; AKG:TSX) H2/16 production increased from 90,000–100,000 ounces to 100,000–105,000 ounces, the company announced in a Sept. 15 press release. Asanko also reported that its mills were operating "at 10% over design capacity at 3.3Mtpa," and that gold recoveries were "exceeding plan."

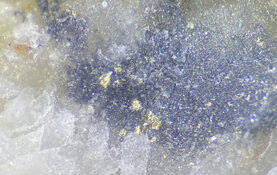

Following that, on Sept. 19 Asanko announced what it called "highly encouraging results from new near-mine exploration target, Akwasiso." The company drilled 81 new holes, uncovering "visible gold intercepts and extensive mineralized intersections of similar style to main Nkran pit."

In a Sept. 19 research report, Raymond James analyst Chris Thompson noted "the Akwasiso target is well positioned to provide supplemental ore to the plant during 2017/18. . .with widths in excess of 10m with significant grades, the initial results from Akwasiso are encouraging and reflect the Nkran shear corridor's exploration potential."

Nana Sangmuah of Clarus Securities, in a Sept. 20 research report, stated, "We believe that the near-mine exploration success coupled with throughput expansion should enable AKG to deliver a significant production boost in 2017 and 2018 before ore from the Esaase is accessed." Esaase represents Phase 2 of the Asanko Gold Mine's development.

Commenting on the news of increased production guidance, analyst Jeff Killeen of CIBC, in a Sept. 15 research report, commented that, "Positively, milled grades for July and August were 2.1 g/t and 2.0 g/t, respectively, representing a significant step up on the Q2 average grade of 1.69 g/t. . .we expect that the increase in grades will be of the most significance to the market today and will help to alleviate any overhang on the stock in relation to the lower grades recorded by AKG in Q2."

Geordie Mark of Haywood Securities was also positive on the guidance announcements. "We deem these new data and H2/16 production projections as highly positive as mining and milling operations appear to be exceeding forecast levels," he wrote in a Sept. 15 research report. "We believe that these operational details bode well for future operational performance."

The analyst also stated that Haywood's investment thesis for Asanko "is built on our belief that the company holds a critical mass of gold resources and reserves at Esaase and Obotan that can be developed to provide Asanko Gold with growth capacity and processing optimality to start initial production on a low cost basis to weather potential commodity price volatility."

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Tracy Salcedo compiled this article for Streetwise Reports LLC. Tracy Salcedo provides services to Streetwise Reports as an independent contractor. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Asanko Gold Inc. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional disclosures about the sources cited in this article

Raymond James, Asanko Gold Inc., Sept. 19, 2016

Analyst Compensation: Equity research analysts and associates at Raymond James are compensated on a salary and bonus system. Several factors enter into the compensation determination for an analyst, including i) research quality and overall productivity, including success in rating stocks on an absolute basis and relative to the local exchange composite Index and/or a sector index, ii) recognition from institutional investors, iii) support effectiveness to the institutional and retail sales forces and traders, iv) commissions generated in stocks under coverage that are attributable to the analyst's efforts, v) net revenues of the overall Equity Capital Markets Group, and vi) compensation levels for analysts at competing investment dealers.

The views expressed in this report accurately reflect the personal views of the analyst(s) covering the subject securities. No part of said person's compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in this research report. In addition, said analyst has not received compensation from any subject company in the last 12 months.

Raymond James Ltd. or its affiliates expects to receive or intends to seek compensation for investment banking services from all companies under research coverage within the next three months.

Raymond James Ltd - the analyst and/or associate has viewed the material operations of AKG.

Raymond James Ltd. has received compensation for investment banking services within the last 12 months with respect to AKG.

Clarus Securities, Asanko Gold Inc., Sept. 16 and Sept. 20, 2016

The analyst has visited the Company's mining operations in Ghana. Partial payment or reimbursement was received from the issuer for the associated travel costs.

Within the last 24 months, Clarus Securities Inc. has managed or co-managed a public offering of securities of this Company.

Within the last 24 months, Clarus Securities Inc. has received compensation for investment banking services with respect to the securities of this Company.

The research analyst and/or associates who prepared this report are compensated based upon (among other factors) the overall profitability of Clarus Securities and its affiliate, which includes the overall profitability of investment banking and related services. In the normal course of its business, Clarus Securities or its affiliate may provide financial advisory and/or investment banking services for the issuers mentioned in this report in return for remuneration and might seek to become engaged for such services from any of such issuers in this report within the next three months. Clarus Securities or its affiliate may buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. Clarus Securities, its affiliate, and/or their respective officers, directors or employees may from time to time acquire, hold or sell securities discussed herein, or in related securities or in options, futures or other derivative instruments based thereon.

Each Clarus Securities research analyst whose name appears on the front page of this research report hereby certifies that (i) the recommendations and opinions expressed in the research report accurately reflect the research analyst's personal views about the Company and securities that are the subject of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research analyst's compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

CIBC, Asanko Gold Inc., Sept. 16, 2016

Analyst Certification: Each CIBC World Markets Corp./Inc. research analyst named on the front page of this research report, or at the beginning of any subsection hereof, hereby certifies that (i) the recommendations and opinions expressed herein accurately reflect such research analyst's personal views about the company and securities that are the subject of this report and all other companies and securities mentioned in this report that are covered by such research analyst and (ii) no part of the research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.

Equity research analysts employed by CIBC World Markets Corp./Inc. are compensated from revenues generated by various CIBC World Markets Corp./Inc. businesses, including the CIBC World Markets Investment Banking Department. Research analysts do not receive compensation based upon revenues from specific investment banking transactions. CIBC World Markets Corp./Inc. generally prohibits any research analyst and any member of his or her household from executing trades in the securities of a company that such research analyst covers. Additionally, CIBC World Markets Corp./Inc. generally prohibits any research analyst from serving as an officer, director or advisory board member of a company that such analyst covers.

In addition to 1% ownership positions in covered companies that are required to be specifically disclosed in this report, CIBC World Markets Corp./Inc. may have a long position of less than 1% or a short position or deal as principal in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon.

CIBC World Markets Inc. expects to receive or intends to seek compensation for investment banking services from Asanko Gold Inc. in the next 3 months.

CIBC World Markets Corp., CIBC World Markets Inc., and their affiliates, in the aggregate, beneficially own 1% or more of a class of equity securities issued by Asanko Gold Inc.

Haywood Securities, Asanko Gold Inc., Sept. 15, 2016

Haywood Securities, or certain of its affiliated companies, may from time to time receive a portion of commissions or other fees derived from the trading or financings conducted by other affiliated companies in the covered security. Haywood analysts are salaried employees who may receive a performance bonus that may be derived, in part, from corporate finance income.

I, Geordie Mark, hereby certify that the views expressed in this report (which includes the rating assigned to the issuer's shares as well as the analytical substance and tone of the report) accurately reflect my/our personal views about the subject securities and the issuer. No part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendations.

Haywood Securities, Inc. has reviewed lead projects of Asanko Gold Inc. (AKG-T) and a portion of the expenses for this travel may have been reimbursed by the issuer.

Haywood Securities, Inc. or one of its subsidiaries has received compensation for investment banking services from Asanko Gold Inc. (AKG-T) in the past 24 months.