There has probably never been a better time to be a copper, gold, and silver mining company. Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB)

A massive copper shortfall is bearing down on the market, which is set to drive it much higher. This is due to a combination of soaring demand for battery applications and solar panels, etc., coupled with waning supply due to very few major new copper producers having come online in recent years, a situation that has taken a long time to fix.

Meanwhile, silver is in high and rising demand for industrial uses with the prospect of a boom in investment demand as the demise of currencies accelerates, which of course will impact gold prices in a similar manner. So Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) is considered to be in the right place at the right time.

Before looking at the latest stock charts for the company, we will review its fundamentals using slides from the company's latest Investor deck and consider any relevant news.

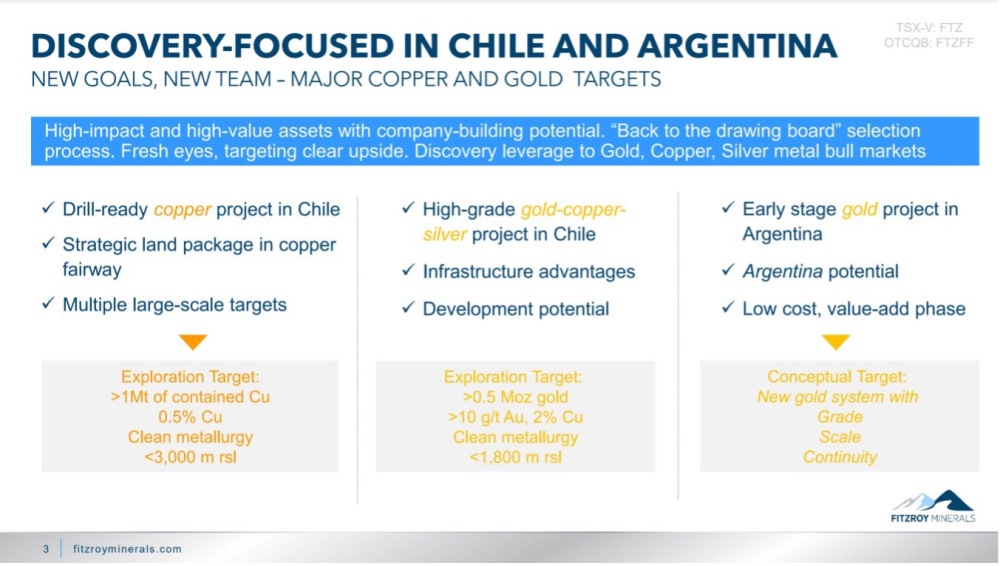

The first slide from the Deck provides a snapshot of the company and its direction. On it, we see that Fitzroy is focused on copper, gold, and silver projects in both Argentina and Chile. . .

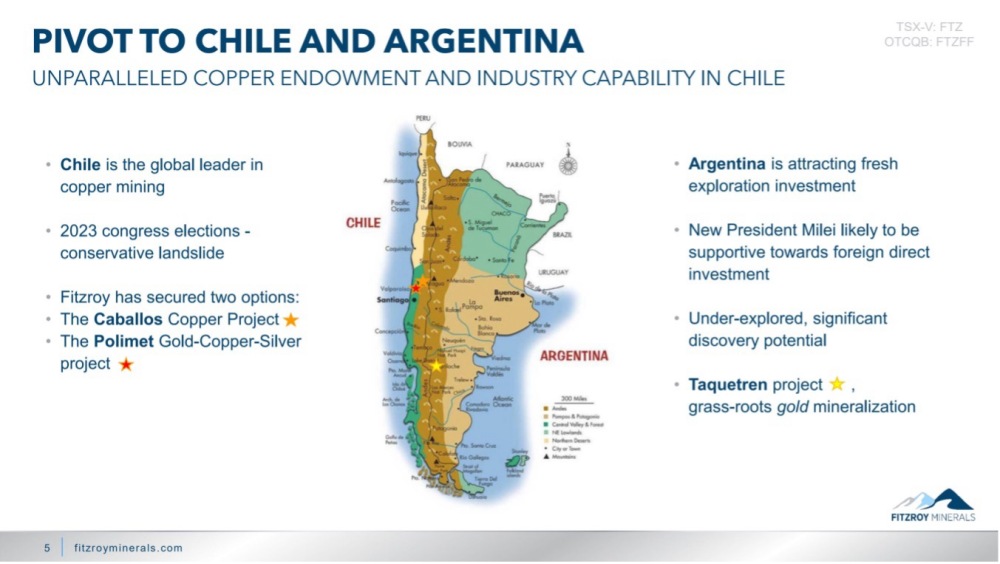

The next slide shows a map of Argentina and Chile and makes the point that the business environment for mining companies is improving in both countries, with a move to the right in Chile and whatever else you may say about him, the current president of Argentina is more business-friendly than previous ones.

Chile is, of course, the world's leading copper producer and, therefore, not surprisingly, is a very good place to look for it. Fitzroy has two properties in Chile and one in Argentina.

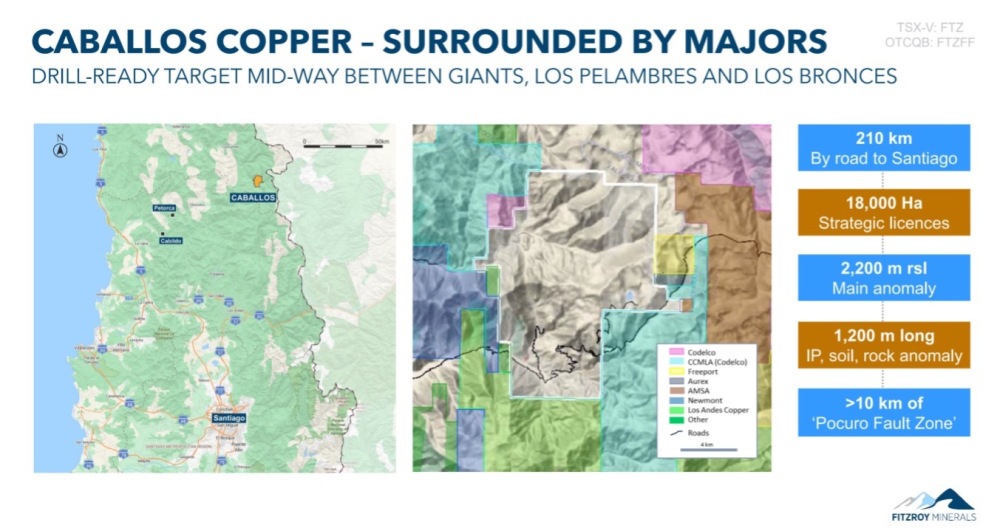

The following slide shows the location of the Caballos (Spanish for horses) project in Chile. As we see it is not very far north of the capital, Santiago, and is close to the border with Argentina.

Most notably, Caballos is surrounded by "heavy-hitting" mining companies, including Codelco, Freeport, and Newmont, who would not be there without good reason. This, just by itself, greatly increases the chances of important discoveries being made within Caballos.

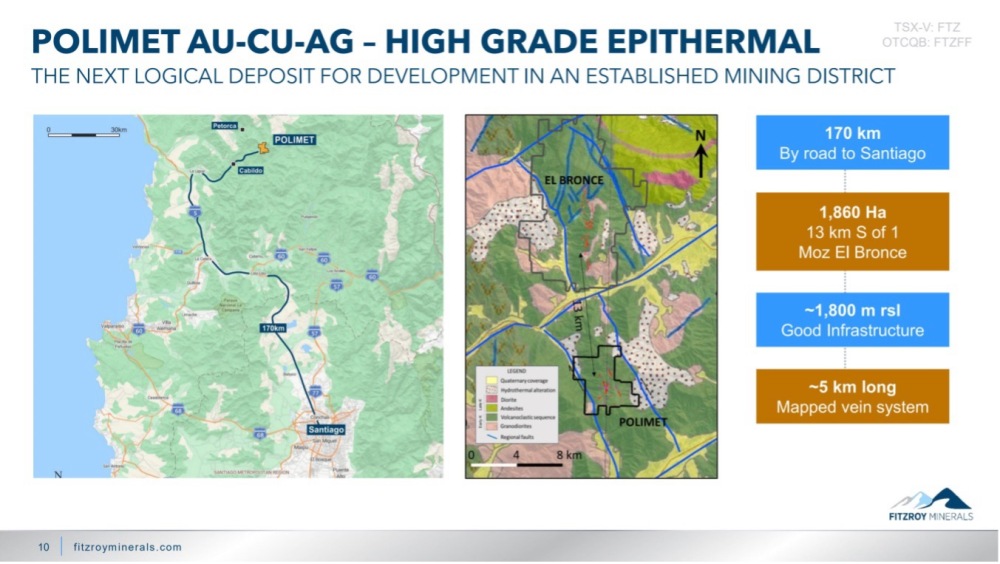

The company's other project in Chile, Polimet, is not far from Caballos to the west, which will make for economies with respect to logistics and movement.

Notably, the project is very close to the giant El Bronce copper mine to the north and is owned and operated by Anglo-American Sur, which certainly augurs well for significant discoveries at Polimet.

Over the border in Argentina and further to the south, the company owns the Taquetren Gold Project where as its name implies the company will be looking primarily for gold there.

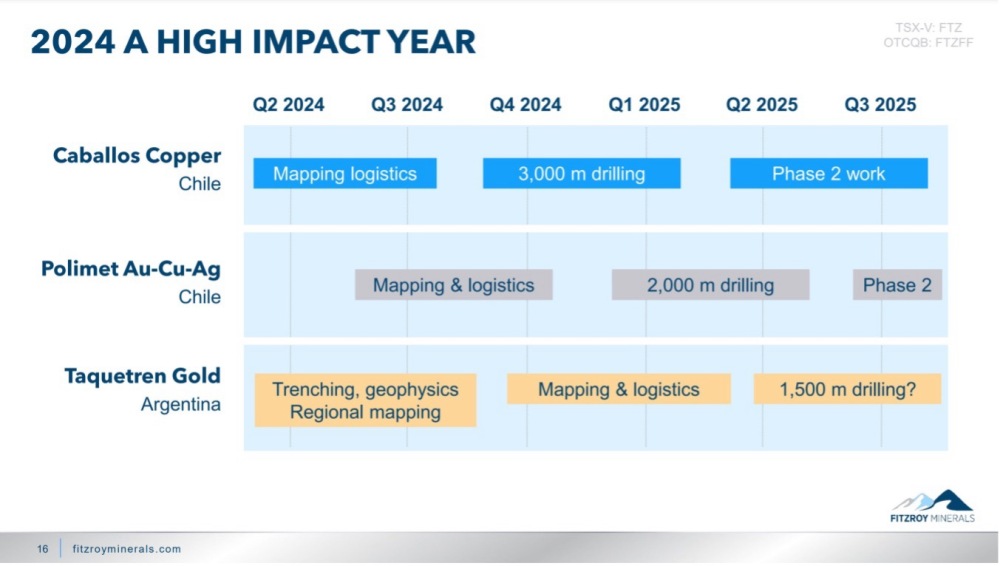

This next slide "storyboards" the company's planned progress at its three projects through the balance of this year and on into 2025.

The company has 91.2 million shares in issue as of August 23, but this number will increase as a result of a just announced financing involving the issue of about 13.3 million shares at CA$0.15, with an option to scale up this financing by a further 10% depending on demand.

Now, we will examine the company's latest stock charts.

Although Fitzroy Minerals has been trending higher since October of last year, it has still not — quite — broken out of the very large base pattern that we can identify on a long-term log chart as being an upsloping Head-and-Shoulders bottom.

On the 54-month (four-and-a-half-year) log chart, we can see how it appears to be in the latest stage of the H&S bottom with the upsloping trendline shown and nearby bunched and bullishly aligned 50 and 200-day moving averages shepherding the price towards a breakout that looks set to happen soon after the just announced financing has been digested by the market.

Should it succeed in breaking out above the resistance marking the upper boundary of the pattern as expected, the mínimum target for the ensuing uptrend will be the 2021 highs at CA$0.76.

Note that the freak drop in the volume indicators towards the middle of last year is an anomaly caused by what looks like a big "cross" trade, an anomaly that can, therefore, be ignored.

The 14-month chart shows recent action in much more detail and allows us to focus on all of the action from the lows of October a year ago. This chart includes the low of the "Head" of the Head-and-Shoulders bottom and also, of course, the Right Shoulder that formed from April through June this year.

On this chart, we can also see that all of the action from October last year also comprises an Ascending Triangle with the price being steadily driven by the rising trendline and the bullishly aligned moving averages just beneath towards a breakout above the resistance marking the upper boundary of the Head-and-Shoulders bottom and with this Triangle now starting to close up a breakout above this resistance is a growing probability and buildup in upside volume in recent weeks that has driven volume indicators higher makes a breakout all the more likely soon, which, as mentioned above, looks set to happen soon after the just announced financing has been digested by the market.

Fitzroy Minerals is therefore rated an Immediate Buy here for all time horizons.

Fitzroy Minerals' website.

Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) closed for trading at CA$0.195, US$0.13 on October 14, 2024.

| Want to be the first to know about interesting Gold, Base Metals, Critical Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] was retained and compensated as an independent contractor by Street Smart to write this article. Mr. Maund is a technical analyst who analyzes historical trading data and he received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.