In the GGMA 2025 Trading Account:

- Bought 25 contracts (25%) position in the SPY May $500 puts at $5.98.

After trading up to $8.66 by shortly after noon hour, they sank to a low of $5.30 before closing at $6.22.

I wrote "Do not chase" shortly after the noon hour, and the afternoon action gave everyone another chance at my $6.00 entry point until the markets sold off in the final 15 minutes.

In bear markets, one of the rules I learned in the 1981-1982 period was to always use the set-up for a long position that prohibits one from buying anything on an "UP" day.

In momentum markets, the likes of which investors have ridden since March 2009, buying dips and then adding into momentum spikes was an effective strategy.

In bear markets, it is the exact reverse. You sell rallies first and then cover the short into dips. With the primary trend down, your odds of winning increase and the losses are reduced by either poor entries or whipsaws by a wide margin.

As for the Actionable Idea, on the Tuesday opening:

- Add tranche #2 to the 25% position at $6.00

- Keep adding 25% for every dollar lower it goes.

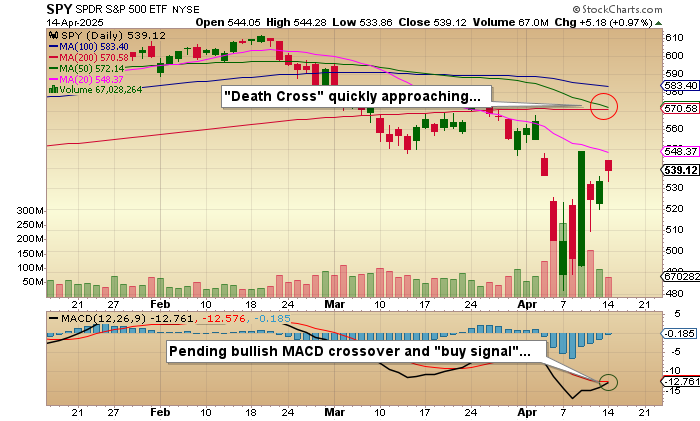

Watch very closely the descent of the 50-dma toward the flattening 200-dma, and despite what might be a bullish MACD crossover, I am betting that the "death cross" will negate the "buy signal" and trigger the move to re-test the lows around $481.80.

With the arrival of the ominous "DC," I will immediately increase the position in the SPY May $500 puts and add VIX June $25 calls. For non-option players, you can use SQQQ:US and UVIX:US as suitable ETF replacements.

Juniors

In addition to the two big positions — Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) — I own positions in a couple of junior explorers (that shall remain nameless that are down 63.33% and 47.67% respectively with neither generating any excitement whatsoever in recent drilling programs.

The sad performance of these companies is a graphic statement on the lack of interest that still pervades the sector. Despite $3,250 gold, $32.75 silver, and $4.65 copper — superb prices on a historical basis — speculators are still steering well-clear of the junior mining exploration space.

As I wrote about this morning, Getchell Gold Corp. is as ridiculously undervalued as was the market's reaction to a truly world-class drill intercept in Fitzroy Minerals Inc.'s recent press release. The "tariff tantrum," thrown by the global markets after "Liberation Day" that threatened to derail the global bond and currency markets, caused a great deal of panic but I honestly did not think for a New York nanosecond that these amateurs would sell FTZ/FTZFF down from CA$0.395 to CA$0.20 because of a minor 17% pullback in the S&P 500 which is up over 940% since the lows of March 2009.

Why sell an obvious winner and a fully-funded winner at that?

Nonetheless, I have some dead weight now, taking up valuable space in both the portfolio account and the trading account, and I intend to contact management about these underperforming issues to find out how management intends to solve the problem. And if I hear the words "difficult market" or "buyers are not to be found", then I will toss these names violently overboard and add instead to my to "big dogs" (GTCH/GGLDF and FTZ/FTZFF) who are breaking their backs delivering value to shareholders despite pervasive investor apathy.

With markets now in full rotation mode, it is time to add to "what is working" and dump "what is not."

(P.S. Every time I walk through the exercise of assessing Getchell Gold's Fondaway Canyon project, I am more and more convinced that I should be paid more than I have for accurately predicting the gold and copper prices almost to the penny since I first launched in 2020. GTCH/GGLDF is about as cheap a stock as you will ever get for the value-per-ounce at which it is currently valued. I have consistently told the world that Fondaway would be an economically viable project since first acquired in 2019, and despite a doubling of the resource, a doubling of the gold price, and the delivery of a Preliminary Economic Assessment detailing a "robust" result and a 46.7% IRR over a 10.3-year Life of Mine, the stock sits at less than a third of its 2022 peak at CA$0.67. Drives me batty.)

| Want to be the first to know about interesting Silver, Gold, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.