Core Assets Corp. (CC:CSE;CCOOF:OTCMKT;5RJ:FRA) has announced the results and interpretation of a three-dimensional magnetic vector inversion (3D-MVI) model collected over the 2024 drilling area at the Silver Lime CRD (carbonate replacement deposit) porphyry project on the central Blue property in the Atlin mining district of northwestern British Columbia.

The company's 3D magnetic model indicates that the Sulphide City Mo-Cu (molybdenum-copper) Porphyry Stock extends deeper and connects to a larger magnetic body measuring approximately 3.7 kilometers wide, which feeds at least three additional porphyry stocks beneath the Pete's CRD and AMP targets, and south of the Gally CRD target.

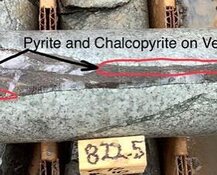

In 2022, drill hole SLM22-006 at Sulphide City reached a depth of 471 meters, revealing significant porphyry-style alteration, veining, and increased molybdenum Mo and Cu grades at around 315 meters depth, with grades near the end of the hole (EOH) returning up to 2.50% CuEq (copper equivalent). Core Assets is fully funded for up to 5,000 meters of diamond drilling as well as project-wide mapping and rock sampling campaigns. The company will start by drill-testing the Sulphide City Mo-Cu Porphyry Stock and the potential source intrusion, with drilling set to begin this week.

Core Assets' President and CEO Nick Rodway commented on the findings, saying, "Overlaps observed between our favorable magnetics, highly chargeable and conductive zones, Cu and Mo grade downhole, and the current drilled extent of the Sulphide City Mo-Cu Porphyry all point towards the continuation of the mineralized Sulphide City Porphyry to depths exceeding 1 kilometer. These overlapping datasets indicate the presence of a large, long-lived, and multi-stage, mineralized porphyry system feeding the high-grade Silver Lime skarn and CRM targets. This interpretation comes with an enhanced understanding of our 3D project geology and structures that acted as fluid pathways for the high-grade massive sulphide and epithermal mineralization observed outboard of the Sulphide City Target."

The Mineral Mining Market

Catalysts

The primary catalysts for Core Assets Corp. in the coming months will be the commencement and progression of their drilling campaign at the Silver Lime CRD-Porphyry Project. The recent discovery of a deeper extension of the Sulphide City Mo-Cu Porphyry Stock, connecting to a larger magnetic body, presents a significant opportunity to enhance the overall resource potential of the project. Located in one of the last unexplored areas of British Columbia's prolific Stikine Terrane, this extension indicates the possibility of additional porphyry stocks, which could substantially increase the project's value.

Core Assets holds a commanding and wholly owned 1,140 km² district-scale land position in British Columbia's prolific Atlin Mining District. Previous drilling in 2022 confirmed significant porphyry-style alteration and mineralization at depth, and the upcoming drilling campaign aims to further delineate these findings, potentially expanding the known mineralized zones and confirming the presence of high-grade Cu and Mo.

Core Assets is fully funded for an extensive drilling and exploration program, which includes up to 5,000 meters of diamond drilling. The immediate focus will be on the Sulphide City Mo-Cu Porphyry Stock and associated source intrusions. The project continues to display characteristics like those of the largest Porphyry-CRD systems globally, covering the full mineralization spectrum from Cu-Mo porphyry through to Ag-Pb-Zn carbonate replacement over a 6.6 km by 1.8 km mineralized area. Successful results from these drill tests could provide substantial data to support resource estimates and attract further investment.

Additionally, the integration of the 3D-MVI model with previous geophysical and drilling data has provided a more detailed understanding of the project's geology and mineralization pathways. This enhanced understanding will guide the 2024 drilling campaign and future exploration efforts.

Furthermore, the company notes that the strategic location of the Blue Property in the Atlin mining district benefits from existing infrastructure and favorable mining conditions, supporting the logistics of the drilling program and future development potential. The project boasts one of the largest and highest-grade documented surficial expressions of any early-stage CRD project, with indications of a potential large porphyry feeder stock nearby. Core Assets' systematic approach to exploration, robust funding, and advanced geological models position the company to potentially make significant discoveries and advance the Silver Lime project toward development.

Investors will be closely monitoring the progress of the 2024 drilling campaign and the resulting data, which could provide crucial insights into the project's overall potential. The Blue Property contains mineralization and alteration assemblages similar to those of major Mexican CRDs and world-class Porphyry Cu-Mo deposits.

Expert Opinions

Analysts and newsletter writers are showing a strong interest in Core Assets Corp. due to their promising developments at the Silver Lime project.

Technical Analyst Clive Maund, on June 6, remarked that "Core Assets is in the latest stages of a fine Cup and Handle base whose development has been accompanied by an exceedingly positive volume pattern and Accumulation line — this means it's very likely to break out upside and soon."

He explained that the duration of this base pattern has allowed the 200-day moving average to drop closer to the price, symbolizing the time required for a significant quantity of stock to rotate from weaker to stronger hands.

"The logical conclusion is that Core Assets is a Strong Buy here for all timeframes and this is a stock that is worth going overweight on," he wrote.

Similarly, Robert Sinn of Goldfinger Capital expressed his enthusiasm on June 5, noting that the news release was filled with geological details but explained in a way that a non-geologist could understand. He highlighted that Core is set to commence a fully-funded 5,000-meter diamond drill program at Silver Lime this week.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Core Assets Corp. (CC:CSE;CCOOF:OTCMKT;5RJ:FRA)

Sinn stated, "To say I am excited for this year's drill program at Silver Lime would be an understatement. At a US$11 million market cap, this is a classic high-torque drill play with substantial potential upside."

He also cautioned that with large upside potential comes significant risk if the drill program does not yield the desired results.

Ownership and Share Structure

According to Reuters Core Assets Corp. has a total of 127.11 million shares outstanding and a market capitalization of CA$19.07 million.

Reuters notes that 9.91% of the company is with management and insiders. CEO Nick Rodway is the largest in this category at 4.40%, with 5.59 million shares.

Strategic investor Zimtu Capital Corp. has 8.09%, with 10.29 million shares.

Institutions own 18.25% of the company. Crescat Capital LLC has 13.84%, with 17.59 million shares. Sprott Asset Management LP has 3.93%, with 5 million shares, and US Global Investors Inc. has 0.47%, with 0.60 million.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.