After three years of strategic patience, Triumph Gold Corp. (TIG:TSX.V; TIGCF:OTCMKTS) is re-emerging with fresh momentum.

Backed by a tight share structure, 2 plus million gold-equivalent ounces in the ground, a new high-grade silver acquisition in the U.S., and unexpected upside in critical minerals, Triumph is becoming one of the more compelling optionality plays in the junior resource sector.

But this isn't just another Yukon drill story. It's a multi-layered exploration company with three highly prospective projects:

- Freegold Mountain in Yukon (gold, copper, silver, tungsten, antimony, polymetallic)

- Silver project in Utah (past producer, bulk sample confirmed 45 oz/t Ag and 0.125 oz/t AU)

- Andalusite Peak in British Columbia (copper-rich porphyry trend)

And now, after a textbook double-bottom breakout on the chart, the stock has momentum behind it too.

About the Company

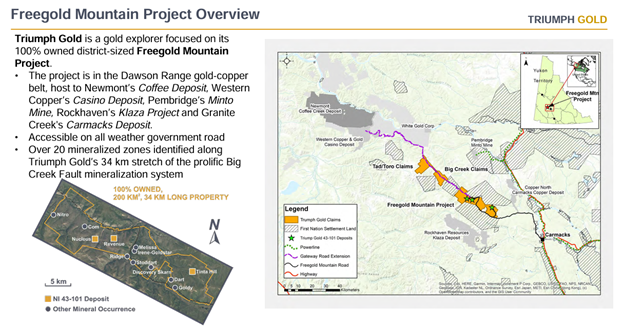

Triumph Gold is a well-positioned junior explorer with a fully owned, district-scale land package in Canada's Yukon Territory. Its flagship Freegold Mountain Project spans 34 km along the mineral-rich Big Creek Fault, home to Newmont's Coffee, Western Copper & Gold's Casino, and Rockhaven's Klaza.

Freegold hosts three NI 43-101 deposits, Nucleus, Revenue, and Tinta Hill, with a combined 2 million gold-equivalent ounces. The property also includes North America's largest known multi-element soil anomaly, suggesting a much larger mineralized system remains to be defined.

More recently, Triumph has expanded into the U.S. with the acquisition of a high-grade silver project in Utah, with historic bulk sampling and drill intercepts pointing to near-term production or spinout potential.

Leadership

The company is led by John Anderson, an industry veteran who has personally funded the company through tough markets to preserve the capital structure. His approach emphasizes long-term value creation through patient capital allocation and tight insider alignment.

Key team members include:

- Marty Henning, P.Geo., Principal Geologist with block-cave experience at New Afton

- Graeme Hopkins, GIS with deep history on the Freegold project

- Emily Halle, PMP, Project Manager, overseeing BC programs

- Paul Cowley, P.Geo. Director, and president and CEO of Phenom Resources Corp. (PHNM:TSX.V; PHNMF:OTCQX; 1PY:FSE) and Indigo Exploration Inc. (IXI:TSX.V)

- A broad technical advisory group with expertise across oxide gold, porphyry copper, block cave mine development, and critical minerals

Share Structure & Strategic Holders

Triumph's market cap sits around ~ US$20 million, which equates to roughly ~ US$12 per ounce in the ground, well below peer averages. Also, the resource cut down over 50% when the last resource was done at US$1,500 Gold, US$2.50 Copper, and no values for the Tungsten Moly or other critical metals

The shares are currently tightly held:

- 42% insider and strategic ownership

- Key holders include European funds, Michael Gentile (~8%), Gold 2000, and Nordic pension funds

- CEO John Anderson personally owns just under 10% of the company

Importantly, Triumph hasn't done a major financing in over three years. Anderson covered corporate expenses himself to avoid unnecessary dilution. The company has only used half warrants in past financings and intends to keep dilution minimal (15% cap on future raises).

Project Highlights

Freegold Mountain (Yukon) Flagship Asset:

- 2 million oz AuEq resource across three deposits, all Open in all directions

- 50% oxide at Nucleus: low-cost heap-leach potential with rapid payback

- Past intercepts include 1.5% CuEq over hundreds of meters, mostly in gold (0.75 g/t calculated at US$1,500/ oz gold)

- Newly recognized Wau (wow)breccia: tungsten-hosted zone within the same system, and the Blue Sky Breccia, 200m apart

- Fully permitted for 1,100 drill holes and already road-accessible

- Historic PEA (2013): NPV of CA$650M at US$1,250 gold / US$2.20 copper

- Today's metals pricing and tungsten inclusion could double that value

Tungsten Upside WOW Breccia

Triumph may be sitting on an unexpected asset class winner. Tungsten, now classified as a critical mineral, recently hit an all-time high price, and China controls 81% of global supply. Triumph's WOW zone returned tungsten-rich values in earlier drilling, though it wasn't even being assayed for at the time.

John Anderson confirmed an initial estimate of 15 million lbs of tungsten and plans to revisit the zone in 2026. Investors comparing this to recent Department of Defense-backed projects like Fireweed and Guardian see serious optionality here, with government interest growing.

- Silver Project (Utah) New High-Grade U.S. Entry

- Historic bulk sample averaged 45 oz/t silver + 0.125 oz/t gold

- 32 drill holes all hit mineralization (vertical only)

- Located 80 miles south of Bingham Canyon

- Fully road-accessible; year-round drilling possible

- Acquisition terms: US$150K + 1M Triumph shares per year over 4 years

Chairman Anderson may spin out the Utah asset into a U.S.-listed silver vehicle when market timing is right, potentially unlocking significant standalone value for Triumph shareholders.

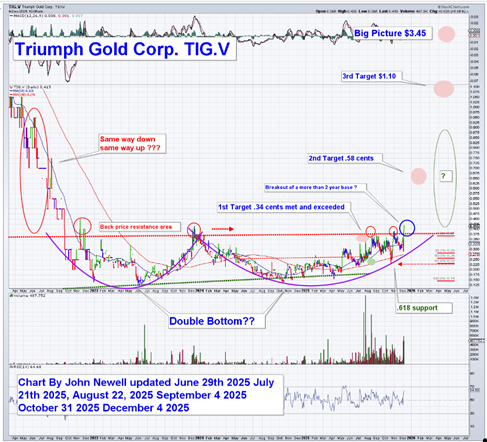

Technical Picture: Breakout of a 2-Year Base and a Symmetrical Setup

Triumph Gold has now broken out of a well-formed two-year base, with price action accelerating through the neckline resistance at CA$0.34 on growing volume. This marks the first major confirmation of a long-term trend reversal, supported by tightening moving averages, a strengthening RSI, and MACD momentum flipping positive.

What makes this setup especially compelling is the symmetry in the chart. The decline from mid-2022 was steep and unrelenting, culminating in a capitulation low that now appears to have been retested and confirmed in 2023. From a pattern recognition standpoint, the current advance mirrors the previous decline, supporting the classic market axiom: "Same way down, same way up."

This type of reversal, where the trajectory of the prior drop becomes the template for the recovery, points to sequential targets on the upside:

- First Target: CA$0.34 (met)*

- Second Target: CA$0.58 (met), sits near a former breakdown shelf*

- Third Target: CA$1.10, coincides with the major support turned resistance from early 2022

- Big-Picture Target: CA$3.45, emerges if the full retracement plays out over a longer timeframe

* This first target was met and exceeded by December 3, 2025. The second target was reached by December 12, 2025. The stock has been taking off toward the third target, and at the time of this article, it is currently sitting at CA$0.70.

Each leg higher continues to be supported by 0.618 Fibonacci retracement levels, and pullbacks have been shallow and met with strong volume accumulation. The structure now reflects a completed rounding bottom with a confirmed breakout, and the increasing symmetry suggests that what took six to nine months on the way down could happen even faster on the way up.

This is a technical setup that offers a clear visual roadmap, and with gold prices pushing into new highs, Triumph is now positioned as a high-leverage chart for both momentum traders and long-term contrarians.

The phrase on the chart, "Same way down, same way up?" could well define Triumph's path into 2026 if the breakout continues. The setup is a textbook reversal.

Strategic Outlook: Low Cap, High Leverage

Triumph Gold has become an optionality play with true multi-bagger potential — backed by asset value, tight ownership, and expansion catalysts across multiple fronts.

Upcoming Catalysts:

- Drilling in Utah (silver) and Andalusite Peak (copper)

- Updated tungsten exploration plans at the WOW zone

- Potential spinout or monetization of U.S. silver asset

- Market re-rating as gold moves above US$4,000 and silver approaches US$50

- Capital-light resource expansion using RC drilling at the Nucleus oxide zone

John Anderson has made it clear: "We're not looking to dilute into a dead market. We've preserved the asset. Now we're going to unlock it, methodically, and with aligned shareholders."

Conclusion: A Five-Bagger Optionality Play with Critical Metal Kicker

Triumph Gold is no longer under the radar. With oxide gold, copper porphyry potential, and critical mineral exposure via tungsten, and now high-grade silver in Utah, the company offers unique leverage in a market turning decisively bullish on metals.

At ~US$12/oz -~US$15/oz in the ground, Triumph trades at a fraction of its 2017–2019 valuation and offers long-term investors a clear asymmetry; therefore, we believe that the shares are a Speculative Buy.

For more information, investors can visit the company website here: www.triumphgoldcorp.com.

| Want to be the first to know about interesting Copper, Silver, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- John Newell: I, or members of my immediate household or family, own securities of: None. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.