Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) has spent the past year quietly building momentum on multiple fronts, through the drill bit, with new partnerships, and on the chart.

The company has stayed focused on its core strengths: smart project selection, high-grade silver targets in a proven district, and a disciplined approach to exploration spending.

And now, the chart and the story may be converging again.

When I first wrote about Silver North in September 2024, shares were trading around CA$0.10. At the time, the company had just pivoted from a prospect generator to a 100% exploration model, placing all eyes on the Haldane project in the Yukon's prolific Keno Hill silver district. That shift, led by CEO Jason Weber, gave Silver North the freedom to drill aggressively on its own terms, and to own 100% of any discovery. Fast forward to today, and we're seeing the results of that decision begin to play out.

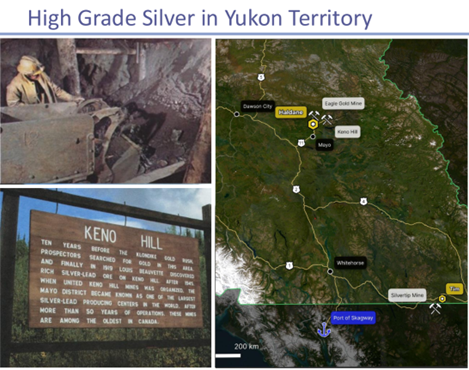

Spotlight on Haldane: A Flagship Asset in a World-Class District

Silver North's flagship asset, the 100%-owned Haldane Silver Project, sits in the heart of the Keno Hill Silver District, one of the highest-grade silver camps in the world. Located just 25 km west of Hecla Mining Co.'s (HL:NYSE) operations, Haldane offers over 12 kilometers of cumulative vein exploration potential, most of which remains untested.

Recent drilling has delivered high-grade silver hits, including 1.83 meters of 1,088 g/t silver and 3.03 meters of 423 g/t silver in the 2024 program. These results suggest the Main Fault and West Fault zones are evolving into meaningful discoveries, especially where mineralized structures intersect the Keno Hill quartzite, a hallmark host rock throughout the district. With only 28 holes drilled to date, and substantial room to grow both laterally and at depth, Haldane could be the company-maker that justifies Silver North's strategic pivot to a 100% exploration model.

New Developments: Drilling, Grants, and CRD Confirmation

In recent months, Silver North has added several key developments to its story. Most notably, its Tim project, currently under option to Coeur Mining Inc. (CDE:NYSE), confirmed the presence of a silver-lead-zinc Carbonate Replacement Deposit (CRD) system through Coeur's 2024 drilling program. While the grades were modest, the geological features were textbook for a growing system. Importantly, Coeur intends to return in 2025 for follow-up drilling, armed with improved geophysical and geochemical data.

Separately, Silver North was awarded a YMEP grant from the Yukon Government for its Veronica property, located next to Tim, which hosts a 450m x 450m multi-element soil anomaly that's never been trenched or drilled. That work, partially funded and starting later this summer, could add another layer of value to the company's portfolio.

Together, these developments reinforce that Silver North is more than a one-project story. They've built an early-stage pipeline in a Tier-1 district, without blowing up the share structure.

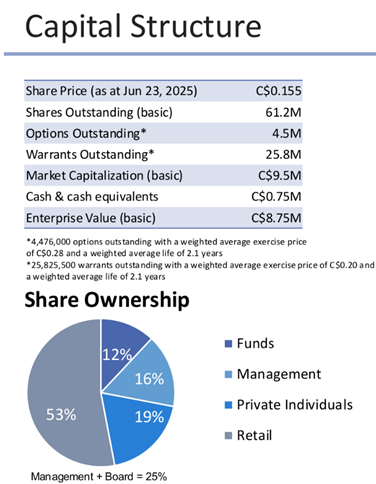

Capital Structure: Tight and Aligned

As of June 23, 2025, Silver North Resources had a basic market cap of approximately CA$9.5 million, with 61.2 million shares outstanding, plus 25.8 million warrants and 4.5 million options. The enterprise value sits around CA$8.75 million, accounting for CA$750,000 in cash.

Importantly, the capital structure remains tight, and management and the board own a meaningful 25% of the company, aligning them with shareholders. Over half the float is held by retail investors, while funds and private individuals own the balance, a mix that reflects early-stage conviction and room for institutional growth as the story matures.

The Chart: Technical Recognition Is Taking Shape

Silver North Resources Ltd. has quietly carved out a compelling reversal pattern after a long and painful downtrend. As of mid-July, the stock has cleared a critical resistance zone around $0.18, what I call the Point of Recognition (POR) , with improving volume and momentum.

This level wasn't broken easily. As the updated chart shows, Silver North made three distinct breakout attempts over the past year before finally pushing through the descending trendline that had capped price action since 2022. That persistence and the clean break above the POR mark a shift in both sentiment and structure.

The stock is now trading above both the 50-day and 200-day moving averages. The MACD has turned positive, and RSI is climbing, yet still leaves room before overbought levels are reached. More importantly, we're seeing a pattern of higher lows, confirming that accumulation has been underway.

Now that the POR level has been taken out, the stock has a technical roadmap with three clearly defined upside targets:

First Target: CA$0.32: The upper boundary of prior trading ranges

Second Target: CA$0.43: A significant shelf of resistance from earlier in the cycle

Third Target: CA$0.55: A longer-term retracement level, if bullish momentum persists

If SNAG can consolidate above this breakout zone, holding the CA$0.18 area as new support, it could begin to attract more attention from momentum traders and silver-focused speculators. The setup reflects a classic early recognition pattern that often precedes major trend changes in the junior resource space.

This isn't just a technical breakout. It's happening against a backdrop of improving fundamentals: a confirmed CRD system at Tim, grant-supported exploration at Veronica, and continued upside at Haldane. With that context, the chart isn't just promising, it's starting to confirm the turnaround story that's been quietly building for months.

Conclusion

Silver North Resources Ltd. has laid the groundwork for what could be a powerful second act. Its strategy to focus on 100% ownership of high-grade silver targets is beginning to bear fruit, both through its Haldane flagship and its partnerships on Tim and Veronica.

From a technical standpoint, the chart has confirmed a shift in sentiment. From a fundamental standpoint, the company is exploring in one of the highest-grade silver districts in the world, with support from institutional partners and government-backed grants.

I believe the shares remain attractive for both short and long-term investors, and the stock is a Speculative Buy at these levels, particularly given the strength in the silver market and the upside potential to a more normalized valuation. Silver North is not a flashy story, but it's quietly becoming a compelling one.

More information can be found at the Silver North Resources' website.

Silver North Resources Ltd. (SNAG:TSX.V; TARSF: OTCQB) closed for trading at CA$0.185, US$0.14 on July 11, 2025.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, between US$2,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- Author Certification and Compensation: [John Newell of John Newell and Associates] was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Newell holds a Chartered Investment Management (CIM) designation (2015) and a U.S. Portfolio Manager designation (2015). The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.

John Newell Disclaimer

As always it is important to note that investing in precious metals like silver carries risks, and market conditions can change violently with shock and awe tactics, that we have seen over the past 20 years. Before making any investment decisions, it's advisable consult with a financial advisor if needed. Also the practice of conducting thorough research and to consider your investment goals and risk tolerance.