I love gold, and I am fond of silver. I would walk across a mile of broken glass in bare feet for gold, but I would never do the same for silver. Never. I would tap dance barefooted on a bed of molten coals for copper and gladly pay the price in metatarsalgian pain but I would refrain from anything vaguely similar for silver.

Silver has beguiled me for decades, while gold has graced me with decade-long servitude and respect. As the venerable billionaire Eric Sprott would say (time after time with ever-increasing intensity), "the ratio of gold to silver in nature occurs at a ratio of 1 to 9, insinuating, of course, a price ratio of 1 ounce of gold to 9 ounces of silver, implying a gold-to-silver ratio of 9.

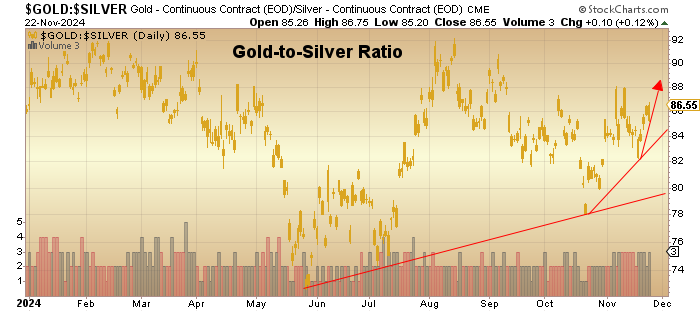

Today, it is at 86.55. If silver is so scarce, as the SilverSqueeze bloggers would have us believe, then why is it trading so out of touch with nature?

The answer, my friends, aside from "blowin' in the wind," lies in the global flow of capital from one printing press to another led by one algorithm instructing another algorithm how to trade and where to invest. Just as a company like Nvidia Corp. (NVDA:NASDAQ) can defy every law governing conventional securities analyses and find itself valued several standard deviations above what might be deemed "bubble valuation," silver finds itself lagging behind gold in direct defiance of its occurrence in geology. The abundance (or lack thereof) of silver in nature relative to gold should never be correlated to price, which is why gold carries the greater relative value.

I looked at the Lundin Mining Corp. (LUN:TSX) website this week to see what I could learn about the Candelaria Mine, an iron-oxide-copper-gold deposit currently the flagship of the company's Chilean operations with a 2024 guidance calling for 170,000 metric tonnes of copper and 110,000 ounces of gold as anticipated production for 2024.

Also included in the fine print was that precious metals occur at a ratio of 1.36 grams per tonne (g/t) silver to 0.10 g/t gold, implying a ratio "in production" of 13.6:1. That would imply that a conventional mining operation is producing 136 times as much silver as it does gold which an even higher GSR than today's 86.55.

In the end, final demand is what carries the day such that comparing central bank accumulators to basement-dwelling laptop traders is like comparing Mount Everest to the Empire State Building. No basis for comparison…

From a trader's perspective, it is the underperformance of the silver market versus gold, as shown by the chart of the gold-to-silver ration (shown below), as well as the dismal action late this week in the gold and silver mining stocks that has me keeping my profit-seeking wallet firmly tucked inside my jacket.

At one point on Friday, with gold up over $48 per ounce,Newmont Corp. (NEM:NYSE) was actually down on the session, and if you try to sluff it off by ring-fencing NEM as a "poorly-run gold miner," Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) was up a meager dime after trading in the red earlier in the session. Even almighty Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE), the superstar of the group, could only muster up a 0.87% move despite impressive strength in the physical metal.

Both Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ) and Coeur Mining Inc. (CDE:NYSE), both prominent silver producers, failed to post positive closes despite a $0.36/ounce pop in December Silver.

I have to stick to my guns when crafting a high-probability trade in either gold and silver or the mining shares, and thus far, this advance in gold since the lows of November 14, as impressive as it has been, looks to this septuagenarian veteran of many a whipsaw, like a whipsaw waiting to happen. It is like a summer moth in search of a speeding windshield as it forges ahead, screaming, "Buy me, Buy me!" despite the total dereliction of duty by its silver counterpart and the miners.

Gold advances that are abandoned by confirming action in silver, and the miners are not to be trusted, and while I would love to join the golden lovefest, I will not. Keep in mind that I own a substantial position in Nevada gold developer/explorer Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), so it is not like I am "out" of the gold market. I have my juniors, and I have my physical metal, but I will let braver souls than I buy the senior miners in here after a $177/ounce rebound.

Fitzroy Minerals

For much of the summer, I have been waiting patiently for the regulators to bestow a green light upon the proposed acquisition of Ptolemy Mining Ltd. by Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB).

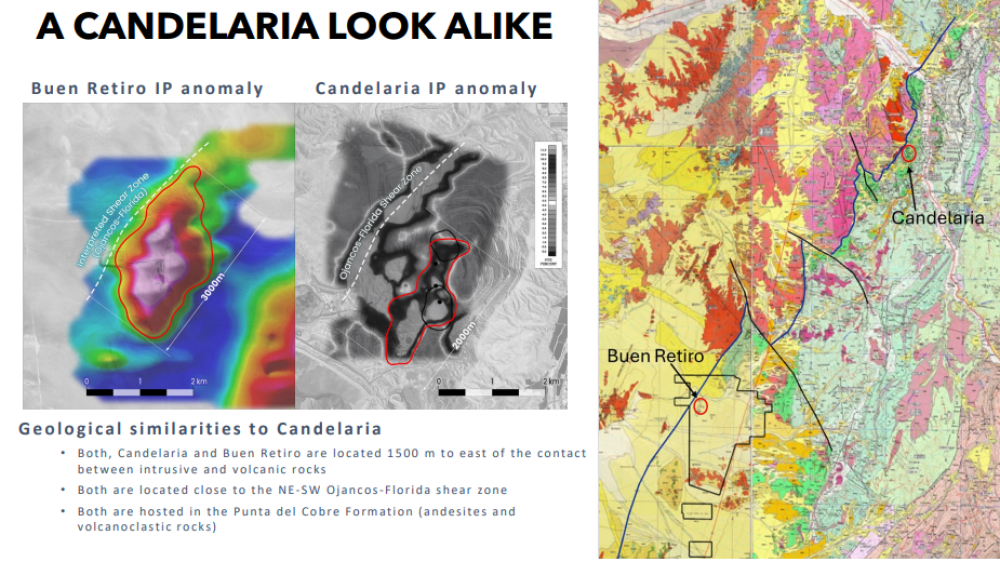

First announced in late-June as a "exclusivity letter agreement" that effectively cleared a path, subject to regulatory approval, for the combination of the Buen Retiro IOCG project located in the Punta del Cobre Mining District in the Atacama Region of north-central Chile.

With over 33,000 meters of drilling and multiple geophysical surveys already completed, Fitzroy planned to exchange 88 million shares of common stock to the owners of Ptolemy worth CA$17.6 million, which would take the issued capital stock to over 217 million. This acquisition significantly de-risked the company and represented a substantial asset complementing their Caballos and Polimet copper-gold-silver exploration prospects as well as the early-stage but highly prospective Taquetren Property in Rio Negro Province, Argentina.

The stock was halted several days ago while the company scrambled to provide several crucial files for the regulators (audited financials, PIFs, etc.) all of which were completed last week with the stock opening for trading Thursday morning. After a long grind, Fitzroy has received regulatory approval after which they can complete the earn-in agreement by which they can own 100% of Buen Retiro.

Trading halts are never viewed kindly by shareholders, and whenever the exchange arbitrarily halts one's stock, it always comes under selling pressure when it re-opens for trading. This was the case last week as it traded 748,164 shares on Thursday, dropping CA$0.05 to CA$0.21, and then another CA$0.015 to CA$0.195 on Friday, 94,734 shares.

Rather than focusing on the caliber and quantity of the acquisition, nervous junior resource shareholders, batted around all year and viciously since the November 5th election outcome, are prone to a "sell first; ask questions later" mentality where the first sale is the best sale, especially after a trading halt. That is the lot of the junior resource sector these days, and when you pile on the regulator's requirement for a minimum CA$2.5 million funding before any work can start on Buen Retiro, you have the recipe for a correction.

I have studied the acquisition with a fine tooth comb since last June despite the company (FTZ) being prohibited from sending out any marketing materials. However, Ptolemy Mining Limited set up its website long before the June letter of exclusivity was reported. Readers can see for themselves just how much work has been carried out on the property, including the IP signature shown above, comparing it to the Candelaria Mine located some 45 kms. NNE of Buen Retiro.

As you can see, there are many similarities between the two ore bodies, which brings pure clarity to the potential prize once drilling commences in early January. Keep in mind what I wrote about earlier: from the Lundin Mining Corp. website, their Candelaria Mine has forward guidance for 2024 set at 170,000 metric tonnes of copper and 110,000 ounces of gold and, as such, represents the flagship of the company's project portfolio.

| Want to be the first to know about interesting Base Metals, Silver, Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp., Agnico Eagle Mines Ltd., Pan American Silver Corp., Getchell Gold Corp., and Fitzroy Minerals Inc.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.