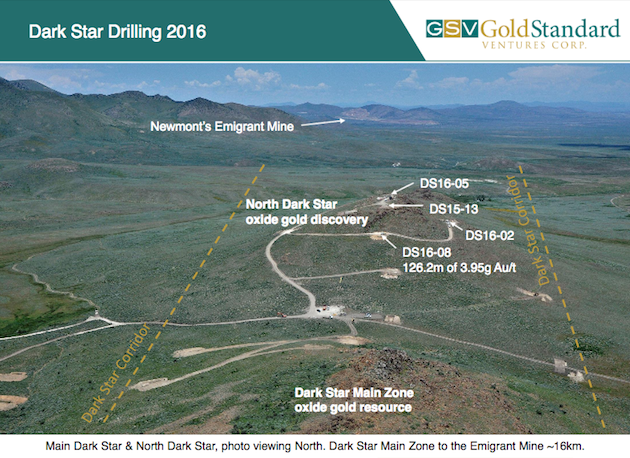

On August 9, 2016, Gold Standard Ventures Corp. (GSV:TSX.V; GSV:NYSE) released yet another barn burning drill hole at their North Dark Star deposit in Nevada in the Carlin Trend. They have done it so many times it's starting to get boring. This was 126.2 meters of 3.95 g/t gold. At today's price for gold, that's $170 rock. Near surface and oxide. Just the way majors like things.

Last year I wrote about them in May when they were $0.66 a share. I said,

"Gold Standard's plans for this year include a 6,000-meter RC drill program at Pinion and Dark Star. That and an increase in the price of gold should be enough to start the share price going higher."

I wrote about them again in November when I said,

"GSV is doing everything they promised. They picked up the Dark Star deposit for $.50 an ounce. Drilling is adding ounces, minable ounces for about $1 an ounce. And they get no respect. This is what you can expect at a major, major bottom. The best companies in the industry come up with mouth watering holes and the stock barely lifts a finger in response.Gold may go lower; tons of people are predicting it. But I suspect that those cherry picking the beaten up juniors at present are going to see their investments go a lot higher when gold catches a bid."

Last year it didn't make any difference what they did or what I said. Often when I wrote a piece all it accomplished was to provide a liquidity event where all the weak hands could dump their shares. The stock was sitting at a blistering $0.69, up a giant $0.03 since May.

Again in December I was pounding away on my keyboard for your edification. I said,

"The bear has been more brutal and lasted longer than any since 1970. But bear markets breed bull markets and the upcoming market is going to be interesting to say the least.We are at the end of tax loss silly season. For the past couple of weeks shares have been dumped on the sales table just because they are down for the year. Many shares are going to recover in the next two months simply because they sold off during tax loss silly season.

The Commitments of Traders numbers are more favorable for gold than they have been for 14 years, going all the way back to 2001. Silver is not quite as positive but still positive. We are perfectly positioned for a bull phase even if you believe gold and silver are in some kind of permanent bear market."

Even though it was tax loss silly season, eventually enough strong buyers bid the price of GSV up to a magnificent $0.88 a share. For the last couple of years shares of some of the finest and best-managed companies in the mining sector were on sale.

That's not true any longer. The market has moved up this year and good companies are up hundreds of percent. Gold Standard was up 500% from their yearly lows to a high of $2.73 before retreating in a perfectly normal correction.

I'd really love to say that I told you so in May and November and again in December of 2015. I kept writing about Gold Standard and investors kept ignoring what I was saying. It would be tacky of me to point out that I was dead right every time and those who listened have made a lot of money. So I won't say I told you so, I'll just think it.

We started 321gold a little over 15 years ago, in July of 2001. I wrote up NovaGold and they doubled. I wrote them up two months later and they doubled again. I realized that I was filling the role of an "early adopter" and all that was happening was I was naming one stock out of the hundreds available. The stocks I picked all went up but it was more because I was making their name known than anything else. They would have eventually gone up on their own.

Since then I have been on hundreds of site visits and seen hundreds of companies, some good, some not. We are in the next phase of this bull market. In the end gold and silver will reach prices people can only dream of today. But now there are dozens of writers who prattle on about stocks that they have never visited and they don't know management or geology. I've seen a lot of stocks rocket higher on a write-up in the last six months that are not worth owning. Stocks that had died and been buried are up 1000% and that's because when the wind is high enough even the turkeys fly.

Investors need to start moving to the really quality stocks. GSV is one of them. Everything I have said about them has been proven to be true and I'm proud of the fact that I "got" it a long time ago.

This last drill hole was a home run. The Dark Star target will expand and one day soon a major will come around with a check in their hands. It had better have at least 9 zeros in it.

Gold Standard is an advertiser. I have been to the project a number of times. Their management and technical are second to none. I am biased as any rational person would be. Do your own due diligence. Do go back and reread what I have written on numerous times in the past, I did get it exactly right.

Gold Standard Ventures

GSV-V$2.51 (Aug 09, 2016)

GSV-NYSE 207.7 million shares

Gold Standard website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The following companies mentioned in the article are sponsors of Streetwise Reports: Gold Standard Ventures Corp. The companies mentioned in this article were not involved in any aspect of the article preparation or editing so the expert could write independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Bob Moriarty: I or my family own shares of the following companies mentioned in this article: None. I personally am or my family is paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Gold Standard Ventures Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.