So what did you tell yourself this summer when gold plummeted 20% in 5 weeks and most gold stocks lost a third or more of their value? Did the dialog help you make a wise decision?

I’ll tell you what I told myself. When I saw a chart of gold’s mid-summer drop, it looked scary…

…then I told myself to take a longer look at gold’s history.

What I saw is that gold’s recent drop is a blip in the big picture. So I told myself, “Maybe you should relax a little.”

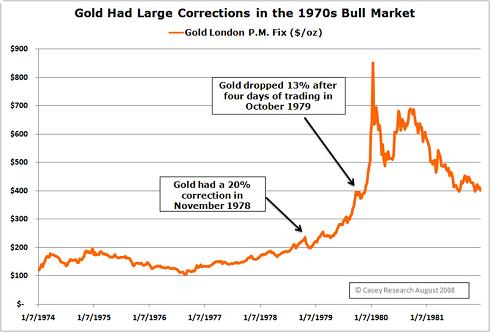

Then I thought about corrections in past gold bull markets. Compared to the historical record, does the recent sell-off look normal? Or is there something about it that suggests our gold bull market is over? Here’s what I found: past bull markets were interrupted by similar drops – and then they came roaring back.

And even within the current bull market, there have been other pullbacks similar to what we’ve just gone through. Gold dropped 21% in the summer of 2006 – but gained 45% by the end of 2007.

So I told myself, “Corrections, including large ones, are normal in bull markets. The sweet stuff is still ahead.”

But enough of charts. What we really want to know is, is the case for gold still intact, or have the fundamentals changed? And the answer, I believe, will give you some compelling things to say if the recent correction has left you arguing with yourself about buying gold.

Think back to mid-July, when gold was pushing higher and was again within spitting distance of $1,000. How did you feel? Were you optimistic? Excited? Of course, and so was I. But what did that optimism have to do with the reasons for gold’s rise? Nothing! You were happy and tingling because gold was moving your way – yet it was rising because inflation was climbing, the dollar had a long-term illness, the government was printing money, banks were failing, falling house prices were threatening the solvency of more lenders, long-term oil supply was dwindling, and the economy was faltering.

Don’t wait for me to ask. Ask yourself: which of those factors have changed in the last 30 days?

If the bull market in gold were over, it would mean that inflation was under control, the dollar’s long-term problems had been solved, the government had become restrained in printing new money, banks were healthy, house prices had stabilized, a surprising new source of energy had been discovered, unemployment was diminishing, and everyone was smiling. That’s not what I see.

So what do I tell myself? “Every fundamental reason that gold is sought as a safe haven is still growing in importance.”

What about gold’s behavior during the economic problems of the 1970s? From December 1974 to August 1976, gold dropped a whopping 48%, even as inflation and the economy’s condition were worsening. We all know what happened next: by the end of 1976, gold climbed 32%. And by January 1980, gold had risen more than 700%.

Today the U.S. inflation rate is 13.4%, almost as high as the worst of the 1970s. Wait, you say, I thought the CPI was 5.6%? According to John Williams of Shadow Stats, measuring inflation by exactly the same methodology the Department of Commerce used in 1980, shows that the true rate is more than double the bogus figures the government is currently publishing. That’s why gas pump and grocery aisle prices are making a mockery of the government’s numbers.

What do I tell myself? “Inflation is out of control and getting worse.”

Even so, gold’s recent reversal was matched by a recovery for the dollar, which the mainstream media attributed to weakness in European economies. With Europe headed for a recession, the dollar’s fall against the euro was over. But are the happy TV faces correct?

First, fundamentals in the U.S. remain weak, especially in the housing and finance industries. In addition, we still depend on borrowing overseas to finance our spending. This will cap the dollar’s gains. Meanwhile, MZM, the broadest measure of the money supply, has grown 16% in the last twelve months. Due to the bloating federal deficit and the big-dollar promises the politicians have made but that the U.S. can’t possibly pay, further rapid growth in the money supply lies ahead. And that means more inflation, which means the dollar’s recovery will turn out to be temporary. And more debasement of the dollar equals higher gold.

What do I tell myself? “The dollar’s ills haven’t been cured. In fact, we haven’t seen the worst of the currency’s decline.”

I interviewed Doug Casey earlier this month and heard the textbook description of a contrarian investor. Doug was reminiscing about how hard it was to get clients to buy gold and gold stocks in the mid-‘70s, how a client even refused to pay for gold stocks he’d just bought, and how the prospects for gold looked bleak to nearly everyone. What did one of the greatest speculators of all time advise?

“You don’t make money buying when you’re optimistic. You have to actually run completely counter to your own emotional psychology. It’s easy to talk about being smart in theory, but extremely tough to apply in practice when it’s real money and you’re scared. But what am I doing now? I’m buying.”

What do I tell myself? “$800 gold is nothing but a buying opportunity. Grab some cash, Jeff, and head to the local coin dealer while it’s still on the SALE! rack.”

Jeff Clark is the editor of BIG GOLD, a newsletter focused on the safest ways to profit from the gold bull market. You can read his 8-page interview with Doug Casey in the August issue, where Doug has much more to say about gold. To position yourself to benefit from what will be the greatest gold bull market in history, try a 3-month risk-free trial to BIG GOLD. Learn more here.