Western Exploration Inc. (WEX:TSX.V; WEXPF:OTC) updated on the Phase 1 reverse circulation (RC) drilling program at the Tomasina Vein Zone target at its wholly owned Aura gold-silver project in an October 30 release.

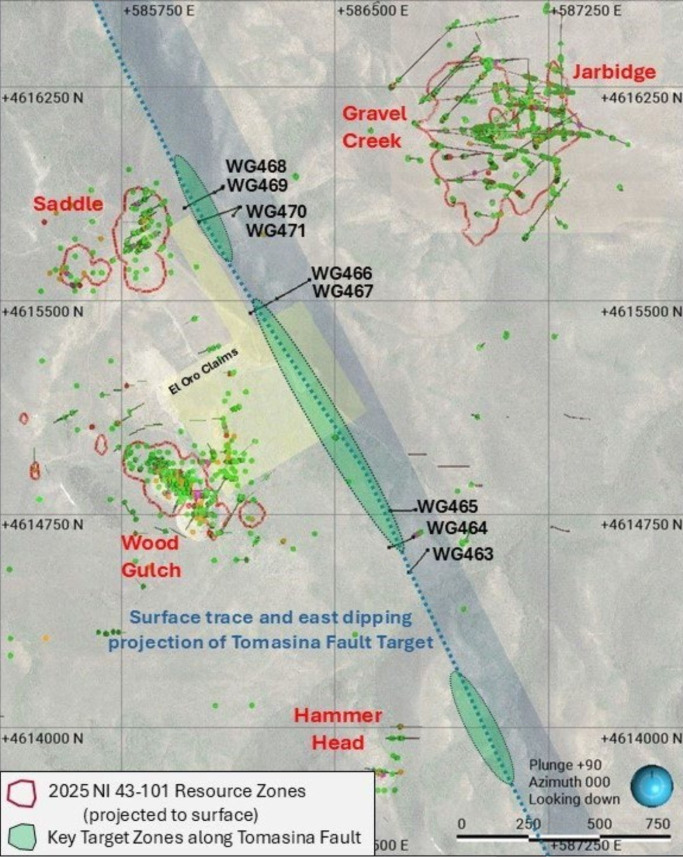

This drill area is located roughly 1 kilometer west of the Gravel Creek resource and down dip from the Saddle and Wood Gulch resource areas, the company said. The Tomasina target is a 2.5-kilometer-long structural zone situated down dip of the Saddle and Wood Gulch NI 43-101 resources and the Hammer Head mineralization.

It is anticipated to intersect the highly favorable Eocene Frost Creek tuff (the main host rock at Gravel Creek) at the faulted unconformity with the basement Permian-Mississippian Schoonover Formation.

Western Exploration completed nine RC drill holes totaling 3,239 meters across the corridor, confirming widespread alteration and veining, which are strong indicators of a robust hydrothermal system, the release said.

These findings underscore the potential for resource expansion at the Aura Project, particularly down dip and along strike from existing NI 43-101 resources. Assay results are currently pending.

"Western Exploration is encouraged by initial visual results of the 2025 RC program, which tested only about 20% of the total strike length of the Tomasina target, said Chief Executive Officer Darcy Marud.

Key areas below Saddle, Wood Gulch and Gravel Creek remain to be drill tested, he said

"Drilling was paused to allow for assay analysis and to extend permitting to next phase targets in this highly prospective target zone," Marud continued. "As the drilling has confirmed the presence of widespread alteration and local quartz and sulfide mineralization, additional drilling will be conducted with core drilling or RC drilling with core tails."

He added, "The 2025 drill results support Western's confidence that the Tomasina target holds resource expansion potential that will complement the growing resource base at Gravel Creek and the Jarbidge discovery 1 kilometer to the east."

Details of Results

In the release, Western Exploration said drilling has confirmed pervasive clay alteration and local quartz-sulfide veining, consistent with mineralized zones elsewhere at Aura.

Holes in the Saddle area successfully intersected the key Frost Creek tuff, the same host rock as the Gravel Creek deposit, featuring irregular stockwork veining and hydrothermal breccia zones, the company said. Drilling at the southeast extension confirmed alteration but did not encounter the favorable Frost Creek tuff, although potential remains to the west and at depth as a prospective target.

Drill holes WG463-465 concentrated on a 200-meter section of the target zone southeast of the Wood Gulch area. Although significant alteration was noted in the overlying Miocene Jarbidge Rhyolite and the underlying Schoonover sediments, only a small portion of the Eocene volcanic sequence was encountered, Western Exploration said.

Further drilling should be positioned farther east to reach the Frost Creek Formation at greater depths.

Drill holes WG466 to WG471 explored a 500-meter stretch of the Tomasina target, located down dip and southeast of the Saddle Resource Zone, according to the company. Three out of five holes intersected the Frost Creek tuff, with alteration extending into the Schoonover basement rocks in all five holes. The Frost Creek tuff is extensively clay-altered, featuring variable zones of silicification and disseminated pyrite.

Both the Frost Creek tuff and the underlying Schoonover Formation metasediments below the faulted unconformity are locally intersected by irregular stockwork veining and hydrothermal breccia zones, ranging from 1.5 to 10 meters in drill width, containing quartz with or without pyrite and marcasite, WEX said.

Gravel Creek Estimate Increases Significantly

In June, Western Exploration submitted a National Instrument 43-101 technical report, which included a preliminary economic assessment (PEA) for the Doby George Deposit and an updated mineral resource estimate (MRE) for Gravel Creek. The revised MRE showed a significant increase in both the quality and quantity of inferred mineral resources, largely due to the discovery of a high-grade vein within the Jarbidge rhyolite east of Gravel Creek. The inferred gold content rose from 367,000 ounces to 571,000 ounces, while inferred silver content surged from 5,307,000 ounces to 9,726,000 ounces, marking an 83% increase in silver content and a 28% improvement in silver grade, according to the company.

On July 31, the Gold Newsletter reported the commencement of the drilling campaign. "The objective is to expand the known high-grade gold-silver mineralization along the Tomasina Fault zone," the report stated. "Successful high-grade discoveries from this drilling could potentially rekindle interest in Western, which currently holds an impressive 1.5-million-ounce inferred resource at Aura. Given its current market valuation relative to this existing resource, and considering the project's substantial potential for further expansion, Western Exploration represents a compelling buy at its present trading price."

In September, the company captured the attention of Paradigm Capital at the Precious Metals Summit in Beaver Creek, Colorado, as reported by Senior Analyst Don MacLean in a research note dated September 17.

"WEX offers leveraged exposure to a district-scale Nevada gold-silver growth story," MacLean noted. "We have been following Western Exploration for some time now and are impressed by the progress it has made in the past year unlocking Nevada's emerging high-grade epithermal potential."

The Catalyst: Explorers Catching Up

The analyst discussed how explorers as a group have performed over the past three years. He noted that during the week of the Precious Metals Summit, explorers were top performers, up 6%, on par with seniors. Such weeks have been rare since the upcycle began in September 2022.

"The ongoing string of record-breaking gold prices is finally building sufficient investor confidence to lift interest on the small cap end of the gold equity spectrum," MacLean wrote. Explorers are up 73% year to date, although they still lag behind the seniors significantly, he wrote in the note.

Even so, MacLean said, they are performing much better this year than in the past two years, when they dropped 21% in 2023 and 18% in 2024, despite gold prices rising 13% and 27%, respectively.

"We can expect a very active explorer financing autumn," MacLean wrote. "We will see whether pent-up explorer demand can offset the normal performance dampening that has occurred, historically, in the face of a substantial wave of financings."

Paradigm expects small caps to continue doing well, supported by a strong gold price environment.

"All indications are that the wind is finally at the back of the small-cap golds after nearly a decade of it being in their face," wrote MacLean.

According to Paradigm's gold cycle model, an average upcycle could lead to US$4,750 per ounce gold in the next year or so. A median cycle would have peaked at US$3,190 per ounce. "However," MacLean wrote, "today's circumstances feel neither median nor average."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

Gold prices edged higher on Friday but were set for a second consecutive weekly decline as the Federal Reserve's cautious approach to future interest rate cuts and signs of easing U.S.-China trade tensions dampened demand for the safe-haven asset, according to a report by Peter Nurse for Investing.com on October 31. At 09:05 a.m. ET, spot gold increased by 0.1% to US$4,027.18 per ounce, while U.S. gold futures rose 0.6% to US$4,039.56 per ounce. Despite these gains, bullion was still expected to fall by about 2% for the week.

Nevertheless, the rally in gold may not be over, as most major banks remain optimistic about its future. JP Morgan analysts reaffirmed their positive outlook for gold, predicting that prices could average US$5,055 per ounce by the fourth quarter of 2026, as reported by Reuters on October 23. Additionally, Bank of America maintained a long position with a target of US$6,000 per ounce by mid-2026, according to Ali's article.

Ownership and Share Structure1

Directors and management own 3% of the company, high net worth individuals hold 9%, Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) has 12%, Auramet holds 4%, and Institutions hold 48%. The rest is retail.

Western Exploration has 52.58 million outstanding shares and 24.96M free float traded shares. Its market cap is CA$40.61 million. Its 52-week range is CA$0.58–1.46 per share.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$3,000 and US$6,000.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc. and Agnico Eagle Mines Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

1. Ownership and Share Structure Information

The information listed above was updated on the date this article was published and was compiled from information from the company and various other data providers.