Is a new bull cycle for the junior miners starting now? Evidence is growing that this may be the case, and to view a key chart highlighting the action…

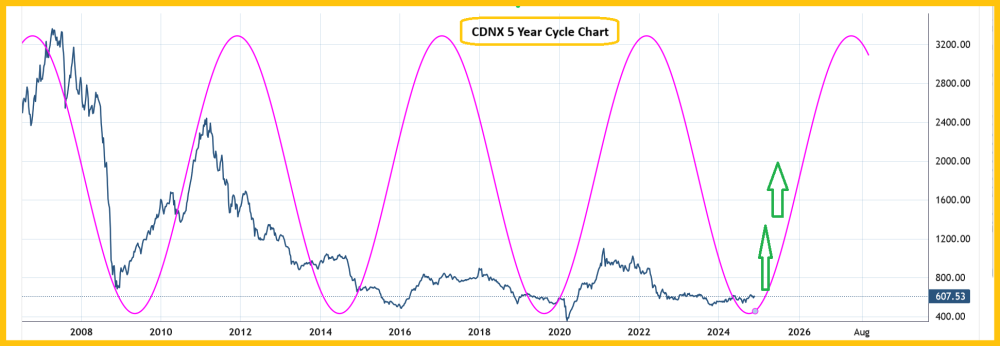

The 5- year cycle for the CDNX has a solid (but not perfect) track record and a major cyclical low appears to be at hand.

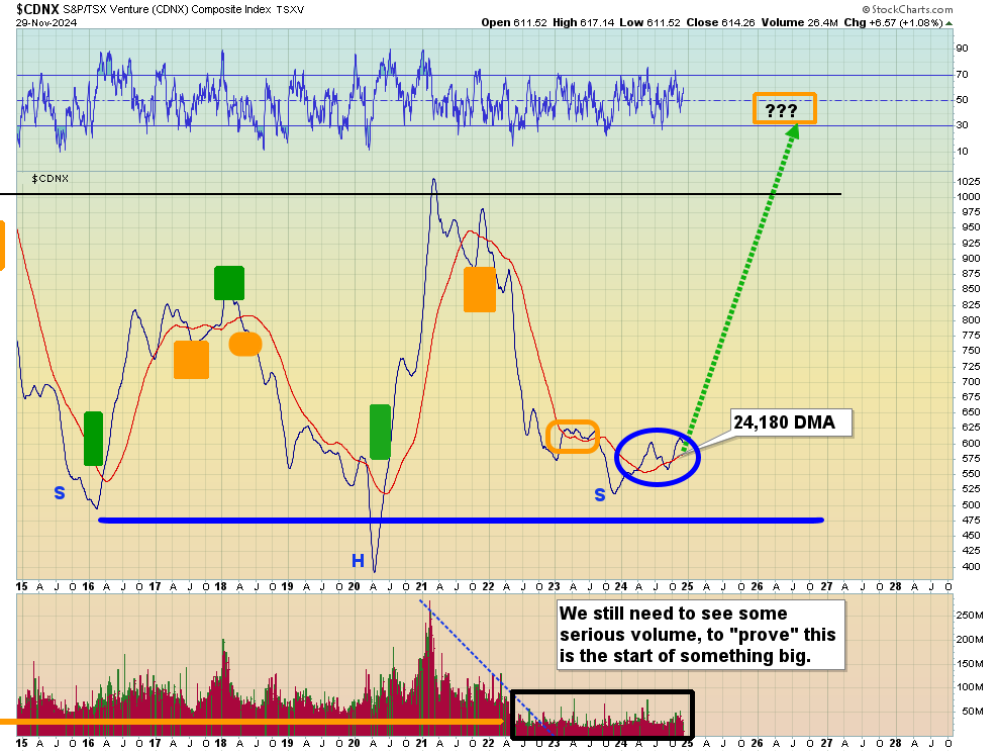

You can directly look at the CDNX below.

This daily chart shows the market rallying from a right shoulder low of a bullish inverse H&S pattern . . . with a target of about 730 for the CDNX.

Over time, I've found that a significant 24,180 DMA cross on the CDNX tends to usher in very large rallies for associated junior miners. The last "proof is in the cyclical low pudding" would be a big (and sustained) surge in daily trading volume, and that's likely to occur as strength of the rally intensifies.

Above is a look at the IWC microcaps ETF. It often leads big rallies in the even small capitalized CDNX stocks. The chart is phenomenal, with bullish inverse H&S action in several places on the chart.

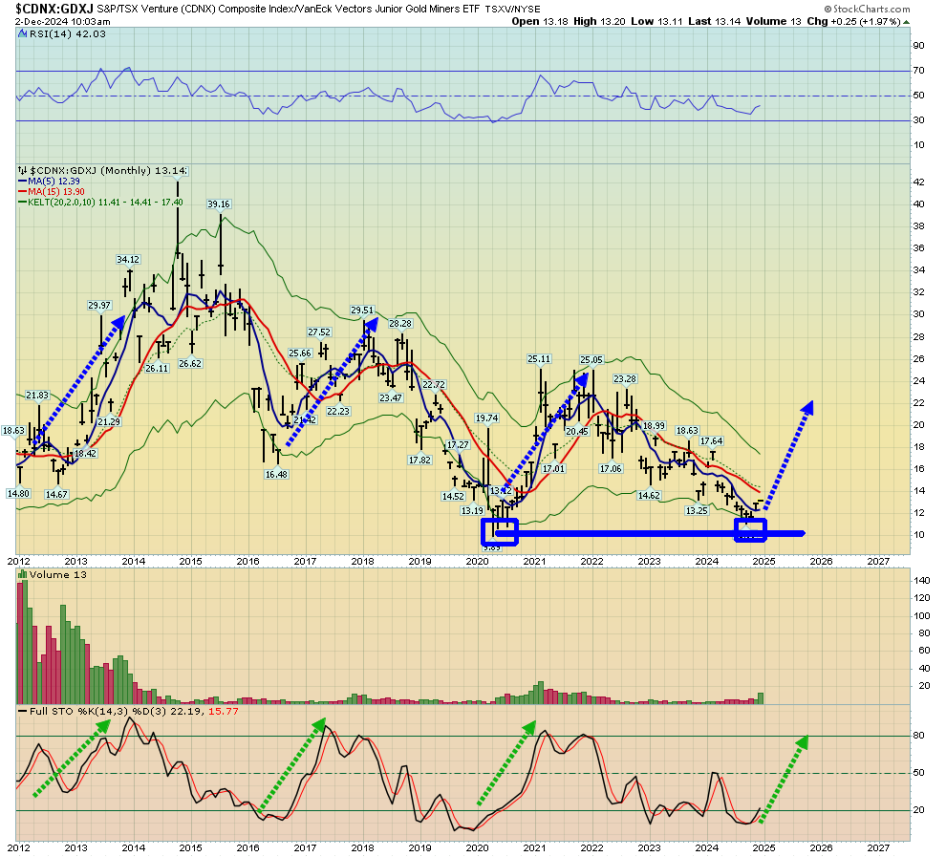

Above is another hugely positive chart for the smaller miners is this CDNX versus GDXJ chart.

Huge rallies tend to occur about once every five years, and it looks like another one is getting underway now.

As for individual miners? Let's look first at Benz Mining Corp. (BZ:TSX.V).

It's possible that Benz could become "Tropicana 2.0." Tropicana is a huge Anglo operation in Western Australia.

There's a massive volume bar in play, and a move to 40 cents looks imminent. From there, more base pattern formation is likely, and then a surge to 70 cents is likely.

I've run a crypto newsletter for many years and I can state categorically that a lot of CDNX junior gold and silver stocks are starting to look as enticing as the top alt coins in the crypto market!

Next, I will share a chart from Rusoro Mining Ltd. (RML:TSX.V).

Despite having its assets confiscated by the Venezuelan government, Rusoro stock still looks good technically and has roared about 60% higher in just the past two weeks.

It looks like it could rally about another 50% from here, to the $1.20 zone. Long-term investors should avoid miners with confiscated and frozen assets, but nimble gamblers should not be afraid of taking small positions based on solid technical set-ups.

Lastly, for today, please take a look at Cosa Resources Corp. (COSA:CNSX; COSA:CSE).

The Company chairman Steve Blower is ex VP of exploration for Denison, and it looks like key deal with that company may be approved by the TSXV today.

Technically, a major breakout gap is apparent on the chart, and "grub stakers" may want to take some buy-side action today. A move to $.50 should be next, followed by one to $.65.

All in all, the CDNX looks bullishly postured, and every week, more and more individual miners are staging long-term breakouts of significance. It's an exciting time for junior mine stock investors, and I dare to suggest the excitement is set to intensify for the next five years!

Special Offer for Streetwise Readers: Please send me an email to [email protected] and I'll send you my free "Junior Gold Stock Thunder!" report. I highlight CDNX miners trading under 50 cents/share that are checking some key "rally time is here" technical boxes. Significant buy and sell zones are noted in this report.

I write my junior resource stocks newsletter about twice a week, and at just $199/12mths it's an investor favourite. I'm doing a special pricing this week of $169 for 14mths. Click this link or send me an email if you want the offer and I'll get you onboard. Thank you.

| Want to be the first to know about interesting Silver and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Stewart Thomson: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Stewart Thomson Disclosures

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?