World Copper Ltd. (WCU:TSX.V; WCUFF:OTCQX; 7LY0:FRA) announced it has filed a National Instrument 43-101 technical report for an updated mineral resource estimate (MRE) for its Zonia copper-oxide deposit in Arizona.

The report is October 24 and was effective August 27, the company said. It differs slightly from totals released in September "as adjustments were made to the calculation for depletion from historical underground workings," the company noted in a release.

The estimate includes 109.9 million short tons grading 0.299% total copper in the Indicated category, or 657 million pounds of copper, and 59.2 million short tons grading 0.254% total copper in the Inferred category, or 301 million pounds of copper.

The report was completed by Sue Bird of Moose Mountain Technical Services, an independent qualified person as defined by NI 43-101. In it, she recommended that the company "initiate a drilling campaign designed to support the completion of a Preliminary Feasibility Study (PFS)."

"The drilling program will necessarily include both infill and exploration drilling with the intent of expanding and better defining known mineralization, and it should include infill drilling sufficient to refine the geological characterization of the deposit (deposit model)," the report continued. "A carefully designed drilling program will allow for collection of the variety of data needed to support the PFS, including samples for both geotechnical and metallurgical test work."

Additional drill holes may be required to allow a better sample representation of the deposit to be developed, the report said.

"These samples would provide a higher degree of confidence for copper extraction across the entire deposit," the reported noted. "Additional samples should be collected towards the upper northeast portion of the mineral resource pit shell as past studies have not included drilling from this area. Although this area has not been tested the geology and mineralization is similar in this area to the rest of the deposit so no major differences in metallurgical properties are anticipated."

On October 24, Technical Analyst Clive Maund wrote that the company's stock was looking "irresistibly attractive here as the setup is 'textbook bullish."

When the MRE was first released in September, World Copper noted it was a "significant expansion" of an estimate done in 2023 and was the result of using a higher copper price and refined moralization models and modeling methods.

"This new report greatly de-risks the project by expanding the indicated resource classification of the deposit," Chief Executive Officer Gord Neal said at the time. "This new resource definition could significantly extend the life of mine of the project. It also has the potential to substantially increase the throughput of future operations and boost the projected annual production profile. Combined with the resource expansion potential of the Zonia North properties, the project is now exhibiting the potential to become a large-scale copper producer."

On October 24, Technical Analyst Clive Maund wrote that the company's stock was looking "irresistibly attractive here as the setup is 'textbook bullish."

"The price has broken out of a fine double bottom on strong volume and a tight bull flag, forming on much-reduced volume that promises another upleg soon," Maund wrote. "Anyone holding should stay long, and the company is rated an immediate Strong Buy."

Next Steps

According to the NI 43-101 report, at least 12 operators have completed about 172,000 feet of drilling of and sampling of various types on the project since 1910, but "not all of the drill data could be verified."

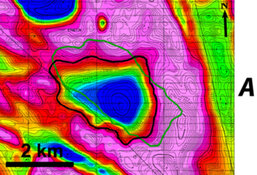

The company has said its next step and largest potential for a new discovery at Zonia is to the north-northeast of the current open pit and resource, where a 2.5 kilometer- by 1.5 kilometer-coincident copper-molybdenum-manganese geochemical anomaly has been identified.

Situated 1.5 kilometers to the north-northeast of the Zonia deposit, it exhibits the same pattern and size of geochemical anomalism to that deposit.

"It is significant that the anomaly is open to the north where outcrops are covered by post-mineral cover," the company noted. "This large geochemical footprint is interpreted to represent a second porphyry center. Nearby historical drill holes indicate the area is deeply weathered and copper-oxide mineralization is present."

The Zonia Norte porphyry target was fully permitted by a previous operator and will be drill-ready when the permitting process is restarted, World Copper said. The company plans to drill 18 holes over 5,000 meters, targeting copper oxide mineralization, and further mapping over the target and adjacent areas is planned.

World Copper said it "remains focused on further advancing the Zonia copper oxide deposit into feasibility and subsequently into production."

The next catalyst expected by the company is the start of a verification drill program on the leach pads at the project. Positive drill results could mean significant pre-production cash for World Copper by moving the project into production quicker in a rising copper market.

The Catalyst: New Exploration Investment Needed

A USA Today report on Monday said copper was trading at US$4.36 per pound. That was down 0.78% from last week, but up 12.03% on the year.

According to Credendo, demand for the red metal could double by 2035, as EVs use more than three times as much of it as gas-burning cars.

"Long-term optimism prevails, buoyed by potential supply imbalances and increasing demand for copper in green energy projects," Fastmarkets noted in an analysis on October 11.

"Beyond the immediate future, the copper market and the price of copper is poised for a bullish long-term trajectory, driven by the energy transition's escalating demand," Fastmarkets' report said. "For instance, by 2025, the copper grade-A cathode premium in Rotterdam is projected to rise by approximately 25%, reflecting tighter regional fundamentals and a recovering European market."

The firm said copper's "long-term outlook remains optimistic."

"As we move toward 2034, refined copper consumption is set to be driven significantly by sectors linked to the energy transition, including electric vehicles and renewable energy applications," the report said. "The anticipated structural supply deficit will likely necessitate increased investments in production facilities, further underpinning a bullish outlook for copper prices."

New investment in exploration will also be needed to fuel the supply of those vehicles in the long term, experts have said.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

World Copper Ltd. (WCU:TSX.V;WCUFF:OTCQX; 7LY0:FRA)

The hunt for copper "has been accelerating, as companies involved in all parts of the copper supply chain realize the structural supply deficit facing the copper market," wrote Rick Mills, author of the newsletter Ahead of the Herd.

"They understand the need to find sources — existing mines, expansions, brownfield projects, greenfield projects, etc. — and are making deals to acquire the base metal, which is not only essential to electrification and decarbonization but industry in general," Mills wrote.

Ownership and Share Structure

Wealth Minerals Ltd. (WML:TSX.V; WMLLF:OTCQB) owns about 9.69% of World Copper, according to Reuters.

About 18% is owned by management and insiders, including Director Robert Kopple with 14.67% and Board Chairman Hendrik van Alphen with 1%. The CEO Neal holds about 0.86%, Reuters said. The rest is retail.

As for share structure, the company has 211.58 million outstanding shares and 125.4 million free-float traded shares, according to Reuters.

It has a market cap of CA$19.04 million. Its 52-week trading range is CA$0.06–0.35 per share.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- World Copper Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of World Copper Ltd.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.