Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX) has announced the commencement of test mining and processing at the Guitarra Mine Complex in Estado de Mexico, Mexico. The flotation plant has processed 5,698 dry tonnes of mineralized material and is currently averaging 259 dry tonnes per day. This milestone is a significant step towards the company's goal of achieving full commercial production of 500 tonnes per day, projected to commence in Q4 2024.

Executive Chairman and COO of Sierra Madre, Greg Liller, expressed his gratitude for the efforts of the team, highlighting the continuous 24-hour operation of the flotation plant since June 25.

He stated in the press release, "The commencement of test mining and processing is a significant step. The flotation plant has demonstrated the value and quality of work done during the refurbishment program." Opening day ceremonies saw attendance from local leaders and government representatives, further solidifying community support for the project.

Positive Outlook for Precious Metals

The precious metals market has shown significant resilience and potential for growth in recent months. A report from Kitco News on July 10 highlighted that lower gold and silver prices during the summer had created strategic buying opportunities. David Brady, an independent analyst, emphasized that this consolidation period was a short-term shallow correction within a broader uptrend.

He projected gold prices to reach between US$2,700 and US$3,000 before a major correction, with long-term potential targets of US$5,000 to US$10,000 an ounce.

Brady noted, "This is the start of a bubble in precious metals . . . This is going to go on for a decade or two, or maybe more, because confidence in fiat money is disappearing."

Assuming the company can get to its next target of production with relatively few hitches, then we can hope for the long-awaited revaluation, and you'll see this company north of US$1," Dominic Frisby of The Flying Frisby stated.

Market Analyst Fawad Razaqzada maintained a positive outlook in a July 8 report on Forex, predicting significant upside potential for gold and silver.

Razaqzada pointed out that silver's impressive gains were due to a breakout from a technical continuation pattern and the dollar's decline against foreign currencies. He stated, "Looking at the long-term chart, silver might be on the verge of a significant move," suggesting that silver could rise toward US$35.00 in the coming weeks.

Richard Mills, writing on July 12 for Ahead of the Herd, reflected on the first half of 2024, noting that their prediction of a "perfect storm of higher prices" for commodities had been accurate. Mills reported that gold reached US$2,393/oz following the release of U.S. NonFarm Payrolls Data.

The sector's growth has been driven by increasing demand from the industrial sector, particularly for silver in photovoltaic manufacturing and gold in electronics. Asia Pacific held a dominant share of the precious metals market in 2023 and was expected to maintain its leading position due to extensive electrical and electronics industries and substantial gold consumption in China and India. Precedence Research reported that the global precious metal market size was valued at US$265.26 billion in 2023 and was anticipated to reach around US$514.06 billion by 2033, growing at a CAGR of 6.84% from 2024 to 2033.

According to Barchart in a June 26 article, gold closed 2023 at over US$2,070 per ounce, continuing its bull market, and reached a new record high in Q1 2024. Silver also rallied, while platinum and palladium prices declined. Early Q2 saw gold and silver taking off on the upside, with gold and silver leading the bullish charge. The turbulent geopolitical landscape remained bullish for metals with industrial properties and long histories as safe havens, investment metals, and means of exchange.

Catalysts

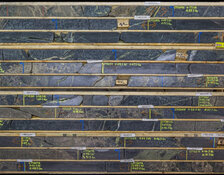

Sierra Madre's Guitarra Mine Complex has shown considerable progress since its acquisition on March 30, 2023, according to the company. The company's Maintenance Department has rebuilt crucial underground equipment, including four operating Scoop trams, a low-profile haul truck, and a Jumbo drill. Additionally, the purchase of new equipment, such as an 18-tonne dump truck and a Stopemate long-hole drilling machine, has bolstered the mine's operational capacity. The current test mining employs long-hole and shrinkage mining techniques, with plans to introduce cut-and-fill operations shortly.

The flotation plant features three ball mills, which are integral to the processing operations. Two of these mills are already operating at 94% of nameplate capacity, and the third mill will be phased into operation as the company progresses toward the 500 tpd (tonnes per day) throughput target. Greg Liller acknowledged the invaluable contributions of the Guitarra team, emphasizing the importance of their work in achieving this milestone.

The mine currently employs 188 individuals, primarily from the local community. Many of these workers have previous experience at the mine, providing Sierra Madre with a skilled workforce familiar with the Guitarra operations. The company noted that this experienced team is expected to play a crucial role in the successful transition to full commercial production later this year.

Analysts Talk Sierra Madre

Dominic Frisby, author of The Flying Frisby, highlighted the significance of Sierra Madre Gold and Silver Ltd.'s recent financial milestone in his July 21 report. "Having secured a US$5 million loan is another step forward and further confirmation that Sierra Madre Gold and Silver Ltd. will soon be producing precious metal. Assuming the company can get to its next target of production with relatively few hitches, then we can hope for the long-awaited revaluation, and you'll see this company north of US$1," Frisby stated.

Thibaut Lepouttre from Caesars Report also provided a positive outlook on Sierra Madre's progress in his July 19 write-up. "Sierra Madre Gold and Silver Ltd. is ticking all the boxes that are required to reopen the La Guitarra silver-gold mine. And with silver trading firmly above US$30/oz and gold now trading above US$2,400/oz, the timing couldn't be better," Lepouttre noted.

On July 15, Oliver O'Donnell of VSA Capital emphasized the unique investment opportunity presented by Sierra Madre. "We believe that Sierra Madre Gold and Silver Ltd. is a highly unusual opportunity where the typical risk-reward for a mine restart is skewed in favor of investors. The company provides highly attractive near-term exposure to near-term silver production, with the tailwind of the stronger commodity price providing a further ameliorating factor to the risk associated with a restart," O'Donnell remarked.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Sierra Madre Gold and Silver Ltd. (SM:TSX.V; SMDRF:OTCQX)

Ownership and Share Structure

Sierra Madre provided a breakdown of the company's ownership and share structure, where management and founders own approximately 24.8% of the company.

According to Reuters, President and CEO Alexander Langer owns 1.96% of the company, Executive Chairman and COO Gregory K. Liller owns 1.78%, Director Jorge Ramiro Monroy owns 1.33%, Director Alejandro Caraveo owns 1.16%, Director Kerry Melbourne Spong owns 0.43%, and Director Gregory F. Smith owns 0.16%.

Institutional investors own 12.9% of the company. Commodity Capital A.G. owns 4.4%, Reuters reported.

First Majestic Silver Corp. is a strategic investor and owns 44.9% of the company.

The rest is with retail and high-net-worth investors.

There are 152.69 million shares outstanding and 102.07 million free float traded shares, while the company has a market cap of CA$68.71 million and trades in a 52-week range of CA$0.25 and CA$0.54.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Sierra Madre Gold and Silver Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.