When you are in the business of writing a weekly newsletter covering a specific range of companies within a market environment that has been/continues to be largely out of favor, it becomes quite a chore to find new things to discuss. I cover gold, silver, copper, and uranium and primarily the junior developers and explorers where there exists the greatest degree of leverage. The leverage to which I refer comes in two forms: the first is leverage to increases in underlying commodity prices, and the second is leverage to discoveries. I also provide technical commentary on the blue-chip names that produce those commodities, mainly to determine if the bigger money flows are entering, exiting, or uninterested in the sector.

The challenges I face in putting out "content" every single week are further exacerbated when markets refuse to follow what used to be considered time-tested rules largely a biproduct of the bank-owned Fed hijacking the capital markets back in 2009 and then assuming the role of "price managers" for literally every financial asset on the planet. With stated objectives being "maximum full employment" and "price stability," the Fed has veered mightily off its dual mandate and now resides purely in the realm of protecting its owners — the global banking establishment — first and foremost while worrying about the jobs and cost-of-living of its citizenry a distant second with the gap between to two widening every morning that the sun rises.

I cite as an example my commentary back in December when I made the remark concerning a certain junior gold developer with a couple of million ounces in Nevada that "a move from where we are now at $2,030 to, say, $2,350 will undoubtedly bring new buyers into the junior gold miners and take prices higher". From that point in December until May 20, gold rose over

$420 per ounce to $2,454 per ounce with the HUI moving from the March lows at 201 to a high of 292 for a 45% move. Now, back in the day, you show me a 45% move in the senior gold and silver issues, and I'll show you a 90% move in the "little guys." Volume would flood into the old Vancouver Stock Exchange where all the hot exploration plays were happening with the boutique players like Canarim Investment Corp., C.M. Oliver, Yorkton, and Union Securities would have 200 salesmen on the phone pitching financings to a very eager public. A 20% up move in gold back then would have watercoolers around the world abuzz with rumors about the Canadian drillers.

My, oh my, how times have changed. The TSX Venture Exchange, always the home for the junior explorers, could barely tack on 16% which meant that there was no leverage whatsoever in the "little guys" and even less in terms of liquidity, as trading volumes on the TSXV remained pitiable.

So, when I sat down to write something about the outlook for the metals as I did when I launched the GGM Advisory in 2020, I felt that with gold at $1,450/oz., silver under $12/oz., and copper under $2.50/lb., IF I was proven correct, those junior explorers and developers listed on the TSXV would have superlative moves, far outpacing their senior gold brethren who, in turn, would have far outpaced the performance of the underlying metals themselves.

Alas, nothing could have turned out to be further from the truth. Outside of a few notable exceptions, the juniors have been total non-performers.

Alas, nothing could have turned out to be further from the truth. Outside of a few notable exceptions, the juniors have been total non-performers.

So when I sit down to write a weekly missive that includes coverage of some of the junior names that I own, I find myself in fear of repeating myself because the story behind these juniors does not change.

They all have highly promising projects and competent management teams.

They are all fully funded and about to begin drilling.

Where these stories run headlong into a brick wall is that they do not have an audience comprised of the younger generations of environmentally-conscious investors willing to see beyond the misnomer that miners are serial polluters.

They care not that their electric cars and heat pumps and cell phones are all going to be consuming enormous new quantities of copper and zinc and silver in order to expand the power and its grid.

All they see is a smokestack from a refinery, and idle slag heaps as solid reasons to avoid the sector — all really bad marketing by the mining industry.

As I sat down this afternoon, totally bereft of any impactful theme for this weekend's letter, I came up with a number of new ideas.

Try posting several charts across an array of mining stocks and indices and delivering a droll, unartistic analysis of the "language of the market."

Squiggly lines, bars, and rounded ellipses, all designed to create a graphic wonderland of future wealth and untold riches.

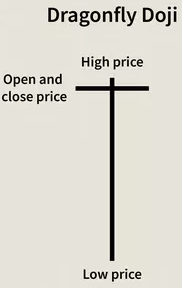

Double bottoms and head-and-shoulders tops, outside reversals and dragonfly "doji's" would all combine to not only mesmerize the reader but also allow me to avoid conjuring up useless things about which to pontificate.

In the absence of anything new about which to write, the only logical recourse was to resort to non-traditional measures.

I even pondered whether to relate some old hockey stories from when I played on the same team as Bill "Goldie" Goldthorpe, arguably the craziest SOB ever to lace on skates and coached by the second craziest SOB to ever smoke a cigar, former Toronto Maple Leaf Forbes Kennedy, whose was the best coach anyone could have ever imagined except when it came to hockey.

NASDAQ Down

The month-end close on Friday was about as obscene as it gets. The NASDAQ was down almost 300 points, with the Mad Six all bleeding from the eye sockets before a last-hour stick save.

With a bastion full of hedge fund managers all about to get "marked-to-market" for the month, by mid-session Friday, the collective bonus pool that gets calculated from trading profits was shrinking rapidly, so what did those young centurions of finance do?

They all teamed up and focused on their AI market leader Nvidia Corp. (NVDA:NASDAQ), which was down $35 by the noon hour, and decided that if they juiced it in the last hour, the ancillary bullish effect on most of the NASDAQ would transform losses into gains and no-bonuses into bonuses.

The NASDAQ climbed from a 290-point loss to close the day down a mere 2.06 points so as to fulfilling their missions of softening the blow of what was the eighth down week out of twenty-two, it was most certainly "Mission Accomplished."

The market commentators pointed to the softer PCE number from earlier in the morning, but all I saw all day long was portfolio managers dumping the technology darlings and switching to the blue-chip Dow stocks, which opened higher and stayed higher all session long. Despite the heroic efforts of the slash-and-burn trading desks, the Dow registered its second weekly downer in a row after four weeks of wins.

What infuriates me to within inches of furniture destruction, which includes computer monitors, television sets, and antique African ashtrays, is what they did with the metals. When the PCE (personal consumption expenditures) was reported at 8:30 am. Friday morning, the gold price shot up from $2,346 to $2,353 in seconds but after trading there for a few minutes, it then proceeded to give up all of the gains and then another $16.80 all because the PCE number hinted at economic weakness. Absurd is a conservative descriptive for such nonsense.

Commodities

Copper got it "right"; it was down both before and after the number was released and hit its low point around the same time that the NASDAQ found its nadir closing five cents off the intraday low. So the investing world discovers that all of those bubbly "resilient consumer" talking points being nattered about by the CNBC cheerleaders for the past six months goes up the financial flue as the bearish evidence begins to pile up.

In a slowing economy, one would think that earnings — the mother's milk of bull markets — might be impacted by the rising credit card debt, the accelerating loan defaults, and the CRE crisis, but what does Wall Street do?

It buys the blue-chip Dow stocks because the soft PCE guarantees that the Fed is going to cut interest rates with little heed to the fact that the Dow Jones Industrial companies will also be impacted by these lower earnings.

When I subject the concept of Jerome Powell cutting rates with 3% inflation rate and unemployment under 4% to a logic exercise, I find that nothing makes any sense. If Powell cuts rates, it will stimulate growth, but the interest rate differential will put pressure on the USD. That will in turn give the commodity group an injection of adrenalin putting upward pressure on raw material costs (producer prices) which in turn impacts final product pricing (consumer prices).

Rising inflation is bearish for stocks and commodities so how does reduced consumer buying power trigger a drop in the metals but a massive jump in the blue-chips?

Why do investors sell gold and silver when they know that weak economic data five months before a U.S. election will need to be dealt with?

As I stated at the onset of this missive, there are days when I find it terribly difficult to write about anything related to investing. Now you know why.

For the record, I am a staunch bull on gold and copper, looking out to 2025 and beyond. There is absolutely nothing in the technical or fundamental schools of analysis that would suggest that this new phase of the bull, now only a mere three months old, has many more months before a top will be seen.

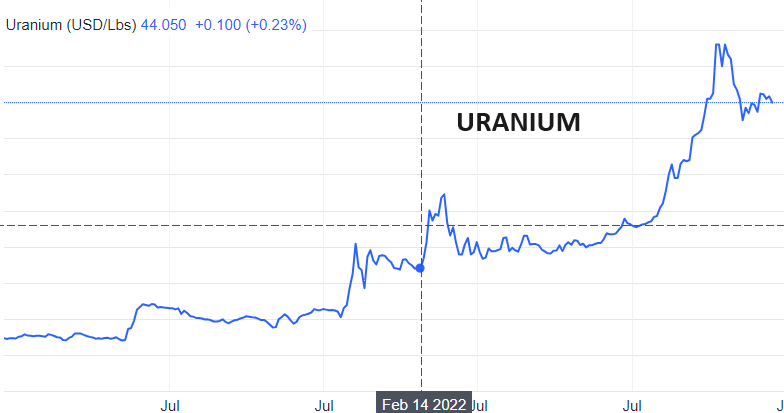

When I launched the GGM Advisory in January 2020, I told my new subscribers that I would be concentrating on gold, silver, and copper with a perfunctory holding in uranium.

As the chart on page five and the one to my left shows, those four commodities have had spectacular moves since the first issue of the GGMA hit the airwaves.

As the chart on page five and the one to my left shows, those four commodities have had spectacular moves since the first issue of the GGMA hit the airwaves.

In fact, the 2020 Forecast Issue made a strong case for gold to see $11,200/ounce before the end of the decade, as sovereign debt levels demand collateral protection in the form of gold.

I have been on the mark with my commodity calls and have had more than a few spectacular trades in companies like Cameco Corp. (CCO:TSX; CCJ:NYSE) and Freeport-McMoRan Inc. (FCX:NYSE) and the Senior and Junior gold ETFs.

As for the junior resource companies, which represent the major portion of my risk capital, there is an excuse used by many portfolio managers where they say, in response to an investment that has yet to produce a return for them, that they were/are "early."

Now, we have all had positions where all of the boxes get checked with the risk-reward ratios leaping off the page and six months after you pull the trigger, you find yourself either flat or down.

In the case of the resource stocks, I have found since the gold market topped out in 1980 that if I called a move in an underlying commodity correctly, I usually need not wait more than a couple of months for the crowd to come wading into my junior position, propelling it to higher valuation and making me and those around me very happy investors.

Well, it has been four years since I first suggested that gold will be a necessity for any and all nations carrying dangerous levels of sovereign debt (bonds) that need to be rolled over as they mature. Gold has risen by $1,000/ounce since 2020, and yet the senior gold miners until recently could barely hold an uptrend, and despite finally catching some bids after the March breakout, the HUI is still 100 points or 37% below its August 2020 peak. Even more exasperating is the TSX Venture Exchange, the trading venue for most of the Canadian junior explorers and developers that tracks the gold price in a closely-correlated fashion.

It is 47% the low seen in February 2021, right around the time the #SilverSqueezer kiddies tried (unsuccessfully) to break bullion bank control over the silver price. What makes this so maddening is that the TSXV has been the breeding ground for dozens upon dozens of discoveries going back to the 1960s and 1970s when it was the old Vancouver Stock Exchange. Many of the discoveries that catapulted thousands of investors from rags to riches were made by investing in companies that traded on the TSXV.

More recently, Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX), a 10-cent penny stock with a project in the Red Lake area of northwestern Ontario, made a significant gold discovery and, within two years, was taken out by Kinross for CA$29 per share. I can name more than a few lithium deals that had big moves, all based upon the commodity price advance and usually where they held a definable resource that could be impacted by the lithium bubble.

The TSXV has had its winners since 2020 but nothing compared to the 1990's when dozens of major world-class deposits were discovered. In the final analysis, I look deeply into the full-length mirror that adorns my wardrobe chest and ask myself the question: "At what point in time does being "early" mean that one is "wrong"?"

GLD:US

Based upon my assessment of the gold market, I determined that while gold is going much higher in 2025 and beyond, the bullish consensus seems to find an inordinately large number of social media influencers now following (and promoting) gold (and their subscription-based services) that I have never seen before. Without naming names, there are literally dozens of fuzzy-cheeked new arrivals into the guru kingdom all spouting off the ten reasons to own gold as if they had been floating in a bottle on the Pacific Ocean for the past fifty-three years.

It was only ten days ago, with copper having gone vertical and gold and silver the same, that I sent out the chart of copper that was entitled "Copper: Time for a Pause," and that was at $4.15/lb. and prompted me to dump my wonderful and beloved position in Freeport-McMoRan at around the $52 level and watched its two main commodities — gold and copper — each goes into a nosedive, with copper now at $4.62 (down from $5.19) and gold at $2,347 (down from $2,454).

Despite that, FCX is holding in amazingly above $50, and that is making me especially nervous. I am hoping (and praying for) a move to the $43-44 level to buy the position back, but I must confess that I am fearful.

As for my trading positions, I have taken out a very short-term position on SPDR Gold Shares ETF (GLD:NYSE) more as a hedge than any thing else by way of the June $220 puts. I see a number of technical red flags, including waning RSI, suggesting that momentum is quickly fading. I see the breach of the uptrend line drawn off the March lows; I see the breach of the 20-dma and the near-breach of the 50-dma on Friday; I see a bearish MACD crossover and "sell signal;" and finally, I see the Money Flow index ("MFI") reversing downward about ten days ago. If GLD breaches the 50- dma, the next stop is the 100-dma at around $203, which was also the range where a flag formed on the first advance off the March low.

A $12 drop in GLD would imply a $120 retracement in June Gold, taking it to around $2,220, which would certainly trim the number of new gold gurus back to normalcy and take us into an oversold condition where subscribers will most definitely be buying back trading positions after ringing the register on the puts.

In case you are all cringing in horror, let it be said that there is nothing sacrilegious about being a gold bull while trading a near-term short position. The big traders I have known over the years care not about the fundamental case for any security; they care only about price and direction. Right now, the GLD looks to be vulnerable to a major shakeout. My choices are to sit and wait until it completes the cycle or try to make a few shekels off it. I choose the latter, and that does not imply that I am the victim of demonic possession in need of Father Karras.

Stocks

On Thursday, I went short the Invesco QQQ ETF (QQQ:NASDAQ), which is the ETF representative of the U.S. technology sector at around the $455 level by way of the QQQ August $425 puts. My rationale on Thursday was that the NASDAQ and S&P could not continue their ascent with the Dow Jones getting hammered all week long.

Until Friday, the Dow Jones was down nearly 1,700 points until the Friday bizarro move took it back up by 574. During these four days, the NASDAQ had two strong up days but only started to fade on Thursday. At 3 p.m. on Friday, I was ahead over 50% on my put positions with the NASDAQ down nearly 300 points and the QQQ down 8.5 points or 1.8%, and it was just about to go "no bid" when the magical mystery tour came charging in with that miraculous stick save that rescued those bonuses.

The chart of the QQQ went from "as ugly as sin" to "bullish" in a very short burst on Friday afternoon as it wound up with a bullish "dragonfly doji" where the close is at or near the high for the session after a deep plunge earlier. I sluff it off as "month-end shenanigans," but it is troublesome because of the tenacity and arrogance of the bulls. Either it was the hijinks of the hedgies, or someone does not want stocks to fade going into the pre-election "Home Stretch." Either way, despite the fact that I am still "up" on the QQQ short despite the rally, I have to believe that the markets will see the weakening consumer as bearish for stocks, which will override the Pavlovian response to rumored or imagined Fed rate cuts. We shall see.

| Want to be the first to know about interesting Critical Metals, Base Metals and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.