Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) new CEO Jason Attew said his goal was to continue building on the progress that has been made in Osisko becoming a traditional royalty company.

In a one-on-one conversation last week, he said, "There will be no backsliding on that," adding, "There is no place" for the incubator strategy or large equity purchases. Attew said his goals were first to ensure stability after the "drama" of the past year and to fix the balance sheet. The debt meant interest payments of $40 million a year, given the new interest rate environment. Already, by applying the proceeds of the sale of Osisko Mining to the debt, there would be savings of $15 million.

He also indicated that the company was agnostic about the commodity; "it's all about value." Right now, about 80% of revenues come from precious metals. Going forward, the focus will be on cashflowing assets, and the company could even sell some of its royalties that are not adding to the company's valuation.

Osisko Misses Guidance, but Balance Sheet Strengthened

Following our conversation, Osisko reported fourth-quarter GEOs ("gold equivalent ounces"), which gave the company a small miss on its 2023 guidance (94.3k GEOs versus the guidance range of 95-105k).

After its third-quarter results, the company said that it expected to finish the year at the low end of its guidance range. At year-end, the company had cash of almost $68 million, and $192 million of debt on its credit facility; it paid down about $136 million from the sale of Osisko Mining.

The stock has responded well to the appointment of Mr. Attew, when it was $12.53), then to the change in chairman (Mr. Roosen's departure), and the sale of Osisko Mining, with a final spurt this past week as Mr. Attew took the reins and contacted large shareholders.

Given the recent rally and the risk of a consolidation in the gold stocks, we are holding but expect to be buying again soon.

The Reservoir Triumvirate Back at Lara

Lara Exploration Ltd. (LRA:TSX.V) announced the appointment of Simon Ingram as president and CEO, with Miles Thompson remaining as executive chairman. Mr. Ingraham also becomes a director. Together with Chris MacIntyre at Corporate Development, this brings together the team that successfully sold Reservoir Minerals at a nice win for shareholders again.

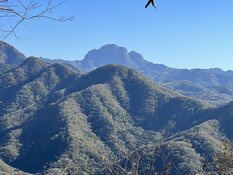

We understand the widely regarded Mr. Thompson is not stepping back but rather bringing in additional firepower. Ingram was a co-founder of Reservoir and, as president and CEO discovered and developed the large Cukaru Peki copper deposit in Timok, Serbia.

He has been brought on board to develop the Planalto Copper-Gold discovery in Carajás, Brazil, now that Lara owns it 100% again. His mandate is to maximize the value of that discovery for shareholders. Plans for additional drilling, an updated resource estimate this quarter, and PFS soon after had already been announced (see Bulletin #881). We are excited about the prospects.

Despite a strong rally this year from 0.475, Lara remains a Strong Buy.

Fortuna's Re-Emergence on Track With Another Debt Reduction

Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE) paid down an additional $41 million of debt on its credit facility, following $40 million repaid in the third quarter. The payments came from the strong cash flows from the new Séguéla mine, which poured its first gold in May. Fortuna which traditionally has had a conservative balance sheet, had committed to using cash flows to reduce debt.

The revolver balance now sits at $165 million, and another $46 million of convertible notes, for a total debt of $210 million against cash of $128 million. Fortuna's stock is undergoing a re-rating as the company experiences a series of quarters with strong operations and, after the start of Séguéla, very strong free cash flow. If operations continue without significant hic-coughs, and as the balance sheet improves, we expect this re-rating to continue, firmly establishing Fortuna as best-in-class among intermediate producers.

Notwithstanding the strong move from $2.60 in early October, Fortuna remains a Buy.

Barrick's Overtures to First Quantum May Come To Nought

Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) is reportedly sniffing about First Quantum Minerals Ltd. (FM:TSX; FQM:LSE) with a view to an acquisition, taking advantage of the latter's troubles — and lower stock price — after the suspension of its Cobre Panama mine. Barrick has not made a bid and is not known to have engaged with the board but has held discussions with major shareholders.

Barrick has indicated an interest in increasing its copper exposure, and First Quantum would be a good fit, given that about half of the company's value, outside of Cobre Panama, comes from its copper mines in Zambia, where Barrick also operates. Barrick CEO Mark Bristow has a strong track record of fixing problems in third-world countries — where Panama now belongs, given its enforced closure of Cobre Panama — we feel confident that he could come to an agreement that would lead to the restart of that mine.

However, we feel that will likely occur later this year under some scenario in any event, but better terms for Panama would be easier to deliver from a new owner. First Quantum, however, has other options, apart from being acquired by Barrick, including selling or partnering some of its mines. News reports suggest that 18% shareholder Jiangxi Copper Group is in discussions to acquire part of the two large Zambian mines; First Quantum has denied those reports.

Nothing may come of the Barrick moves. The company has a history of missing out on acquisitions because of a reluctance to pay meaningful premiums; First Quantum shareholders — and over 40% is held by its top two shareholders — may be reluctant to sell now at a depressed price. If a combination were to be effected, however, Barrick would see about 45% of its revenues from copper (assuming the restart of Cobre Panama, which would represent about 20-25% of the NAV of the combined company).

We are holding.

It Could Be an Exciting Year for Orogen, as It Awaits Anglo News

Orogen Royalties Inc. (OGN:TSX.V) announced its plans for prospect generation and exploration for 2024, with nine projects under option and two partner-funded generative alliances. Four partner-funded drilling programs are expected this year, down from six last year, though additional drill programs could be announced during the year. Two of the programs will be in Nevada, and the other two in Western Canada. The company continues to generate and option projects, with exploration at the partners' expense.

In addition, significant news is expected this quarter from AngloGold on its Beaty project in southern Nevada. A maiden resource at Merlin is expected, as well as a new "concept study" on Silicon, with a Pre-Feasibility Study (PFS) to follow.

Orogen has a 1% royalty on these two deposits, which eventually may be mined as one. Anglo has previously announced a 4.2 million ounce "mineral resource" at Silicon and a 6–8 million ounce "exploration target" at Merlin but has made high-grade discoveries at Merlin since then.

Another company on our list, Altius Minerals Corp. (ALS:TSX.V), separately as a 1.5% royalty on the entire district, though the extent of the ground covered by the royalty is disputed by Anglo and the subject of an arbitration proceeding set for May.

Orogen is well funded, with revenues of US$4 million in 2023 from its royalty on First Majestic's Ermitaño deposit in Mexico. Revenues of $3-4 million a year are expected for at least the next four years from the deposit. It received another CA$3.5 million last year from the sale of projects and payments from exploration partners.

The stock, which has been one of our "Top Buys" most weeks for the last four months, is now at the high end of its recent range. If you do not own it, you can buy it, but for additional purchases, we are looking to buy on any pullbacks.

Royal Likely Missed Annual Guidance

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX) reported its streaming revenues a little light, particularly on the silver, due mainly to delays in the Pueblo Viejo mine expansion.

Sales were helped by a reduction in gold inventories at quarter end. Streaming sales represent about 70% of Royal's revenues, with royalties representing the balance.

It is likely, therefore, that total 2023 revenues, when released in mid-February, will turn out to have been below guidance.

Hold.

Vista Commence Drilling and Staged-Development Plan

Vista Gold Corp. (VGZ:NYSE.MKT; VGZ:TSX)) announced plans for a significant drill program at its Mt Todd project in Australia as well as conducting additional study on a staged development strategy for the large mining project. This additional work has been discussed as an option (see Bulletin #879) and then was expected after Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) paid $20 million for a stream.

The drilling will focus on the area adjacent to the main Batman deposit. Last year, the company released the results of an internal scoping-level study looking at the feasibility of starting with a smaller-scale mine with scalability.

Vista will be continuing that work to upgrade the study. Although the work makes sense and could enhance the value of the project, to us, it is a clear indication that the company has not received a satisfactory offer for the project. Though the state of the capital markets is doubtless, one reason for this, another is that the company appears to be holding out for an offer that may be unrealistic in current circumstances.

Hold.

TOP BUYS this week, in addition to above, include Nestle SA (NESN:VX; NSRGY:OTC), Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Altius Minerals Corp. (ALS:TSX.V), Metalla Royalty & Streaming Ltd. (MTA:TSX.V; MTA:NYSE American), and Midland Exploration Inc. (MD:TSX.V).

INVESTMENT LEGEND If you missed our interview with Jim Rogers, a replay is available here. It was an engaging discussion with and an analysis of our current situation and many pearls of wisdom, including his parting words, "be very careful."

QUIS CUSTODIENT IPSOS CUSTODES? The SEC has recently introduced new rules and procedures for those it regulates concerning both social media and cybersecurity, which we won't go into here. Suffice to say, however, that the SEC was again hacked, this time its account on X. This, however, is only the latest in a string of cyber failures at the SEC.

Bloomberg said, "Cybersecurity measures at Wall Street's chief regulator have repeatedly been found to be lacking." An attorney for SolarWinds, a software company that was sued by the SEC over a hack, commented that "regulators should approach cybersecurity with great care and humility." Among other failures, the SEC was not adhering to federal government standards, including a requirement for multifactor-authentication, some it requires of those it regulates, and in fact, something that many people use as a standard security measure.

An independent evaluation two years ago noted this failure, as did an internal review last year. Yet, according to Elon Musk, as of last week, the SEC was still not using two-factor authentication to post and change its X account. One rule for me and another rule for thee. This is arrogance, hypocrisy, and incompetence on a monumental scale, yet these people can still tell us how to run the minutiae of our business.

| Want to be the first to know about interesting Gold and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Osisko Gold Royalties Ltd., Lara Exploration Ltd., Fortuna Silver Mines Inc., Orogen Royalties Inc., Altius Minerals Corp., Franco-Nevada Corp., Altius Minerals Corp., Metalla Royalty & Streaming, Midland Exploration Inc.].

- [Adrian Day]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [All]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Adrian Day Disclosures

Adrian Day’s Global Analyst is distributed for $990 per year by Investment Consultants International, Ltd., P.O. Box 6644, Annapolis, MD 21401. (410) 224-8885. www.AdrianDayGlobalAnalyst.com. Publisher: Adrian Day. Owner: Investment Consultants International, Ltd. Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2023. Adrian Day’s Global Analyst. Information and advice herein are intended purely for the subscriber’s own account. Under no circumstances may any part of a Global Analyst e-mail be copied or distributed without prior written permission of the editor. Given the nature of this service, we will pursue any violations aggressively.