Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) announced Tuesday that tests performed on samples from its Wicheeda rare earth element (REE) project in British Columbia confirm the production of high-grade flotation concentrate at high recovery just as analysts note world events have made the need for the mine more pressing.

"Our recent results show that the Wicheeda feedstock can be crushed, ground, and floated to produce a rare earth flotation product with similar or better recoveries and grades to the top producers globally," said Craig Taylor, Defense Metals' chief executive officer. "Our project has many favorable conditions for success: mineralogy, metallurgy, infrastructure, and community collaboration further supporting a path to production."

Right now, China accounts for about 60% of REE current mine production and more than 85% of the refined output of REEs. Bob Moriarty of 321gold.com wrote that attacks by Hamas on Israel show how critical it is for the West to find more sources of the minerals.

"The lack of any production of REEs in North America is critical," Moriarty wrote. "In an unstable world, it is vital to have control of the resources you need to maintain your economy. The U.S. and Canada have mumbled about getting involved in helping junior mining companies advance their projects of critically necessary minerals. Now would be a good time to stop talking and start acting on those discussions."

Wicheeda has "the potential to be a globally significant producer" of REEs, analyst Mark Reichman of Noble Capital Markets has noted in a research note.

Wicheeda has "the potential to be a globally significant producer" of REEs, analyst Mark Reichman of Noble Capital Markets has noted in a research note.

"The project has several competitive advantages, including a mining-friendly location, well-developed infrastructure, and a strong technical team," Reichman wrote. He kept his Outperform rating on the stock and set a target price of CA$0.70 per share.

"Wicheeda is well positioned to take a leading role in the North American and Global REE supply chain," Reichman wrote.

Flotation Recovery, Concentrate Grades 'Very Favorable'

The comminution and beneficiation test work was done by SGS Canada Inc. in Lakefield, Ontario, on Wicheeda samples, the company said.

A total of 90 open-circuit flotation tests, using 1 or 2 kilograms of feed, were conducted on seventeen individual variability samples, various composites, and blends. Considering all open-circuit flotation tests, at a feed grade of 3% TREO (Total Rare Earth Oxide), the best-fit line indicated 80% recovery to a 45% TREO concentrate, Defense said.

After issuing a Buy alert on Monday, Technical Analyst Clive Maund rated the stock a Strong Speculative Buy Tuesday.

In addition, 29 bulk flotation tests using 10 or 12-kilogram charges were completed to both further optimize parameters and generate 16 kilograms of 46% TREO content with a recovery of 78% for use as feed for hydrometallurgical tests.

The company said very favorable results were obtained in a locked cycle test on a deposit composite, giving a recovery rate of 85% of the rare earths at a concentrate grade of 50.7% TREO.

The work confirms and expands on data obtained during 2020 pilot plant work, Defense said.

"The new results are close to those reported earlier and used in previous studies," noted John Goode, a consulting metallurgist to the company. "Grinding energy requirements have been shown to be relatively low, and flotation recovery and concentrate grades are high and very favorable."

The Catalyst: Stock at 'Cyclical Low'

After issuing a Buy alert on Monday, Technical Analyst Clive Maund rated the stock a Strong Speculative Buy Tuesday "Because, after a long and grueling decline for much of this year, it is viewed as way oversold and is down at a cyclical low at strong long-term support with downside momentum easing and the recent volume pattern bullish and Accumulation line positive relative to price."

"It's surprising how far this stock has retreated this year given the company's assets and what it looks set to produce," Maund noted.

A long downtrend from February of this year has begun losing momentum and morphed into a bullish Falling Wedge, the analyst wrote.

"On the five-year chart, we can see that while the overall trend is neutral, this year's reaction has brought the price back into a zone of quite strong support at a cyclical low, which is a good point for it to turn up, and this is made more likely by the ramping up of conflict around the world increasing the demand for the rare earth metals that the company will produce coupled with the growing likelihood that either the government or a big company or companies will show up to expedite the company achieving its objectives," Maund wrote.

Defense Metals recently announced what one analyst called a "significant upgrade" to its Mineral Resource Estimate (MRE) for Wicheeda, increasing the total TREO by 17%, or a 31% tonnage increase, compared to an MRE in 2021.

The MRE comprised a 6.4 million tonne Measured Mineral Resource, averaging 2.86% TREO; a 27.8 million tonne Indicated Mineral Resource, averaging 1.84% TREO; and an 11.1 million tonne Inferred Mineral Resource, averaging 1.02% TREO.

The results are reported at a cut-off grade of 0.5% TREO within a conceptual open pit shell, the company said.

World in Conflict

Moriarty noted that the company could produce as much as 10% of the world's REEs at full output.

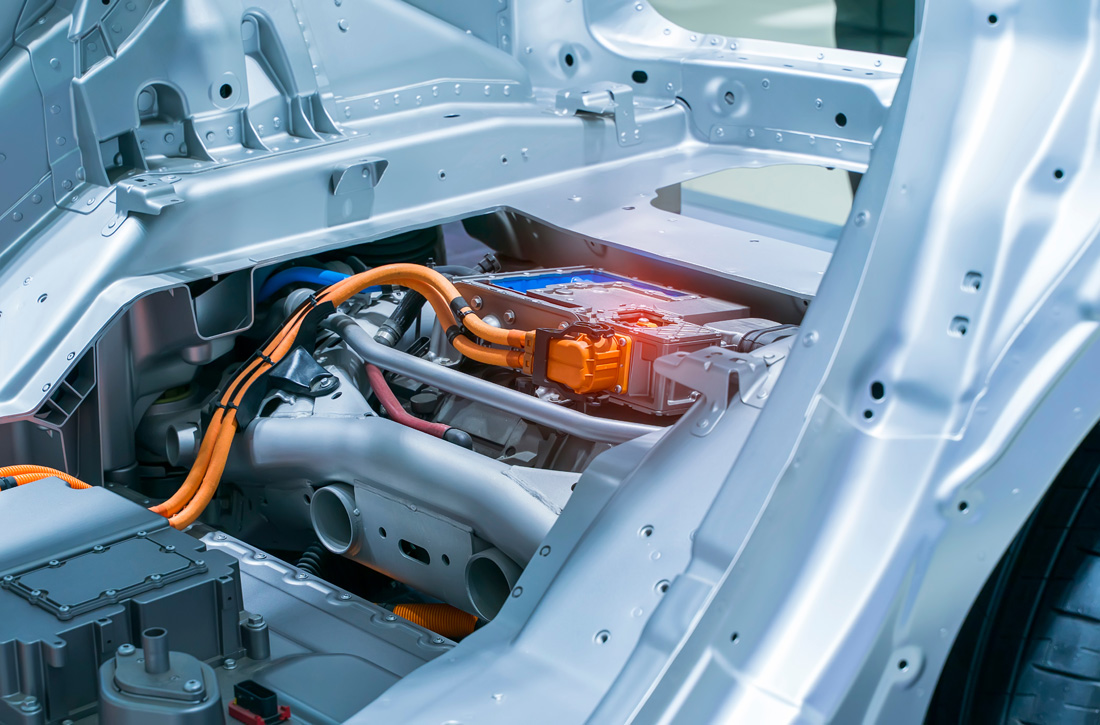

"The world is in a conflict, and finding a reliable source of supply for critical minerals is far more important than price," Moriarty wrote. "The U.S. and Canada have made a giant mistake in outsourcing both mining and production over the last few decades. As a result, China has a stranglehold on the supply of rare earth elements primarily used to create powerful magnets for electric vehicles, but also the critical materials for things such as video screens for television and cell phones."

The global market for the elements is expected to grow from US$2.6 billion in 2020 to US$5.5 billion in 2028, according to a report by Fortune Business Insights.

"The rising demand for consumer durables such as tablets, laptops, and smartphones (are some) of the factors driving the consumption of rare earth elements," the report said. "The demand for these elements in developing economies is estimated to expand rapidly."

Once it reaches commercial production, Wicheeda is expected to produce more than 25,000 tonnes of rare earth oxide annually, Reichman wrote.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE)

"It all begins with developing a world-class deposit that contains high-quality ore," Reichman wrote. "We think Defense Metals is well positioned to benefit from growing demand for rare earths for use in electric vehicle batteries, metal alloys, and advanced technology applications."

Ownership and Share Structure

About 5% of the company's stock is owned by insiders, including Director Andrew S. Burgess with 1.63% or 4.18 million shares, and CEO Taylor with 0.98% or 2.5 million shares, according to Reuters.

About 11% of the company is owned by institutional entities, including RCF Opportunities Fund II LP, with 10%, the company said. The rest, 84%, is retail.

Defense Metals has a market cap of CA$49.88 million with 255.78 million shares outstanding and 212.98 million free floating. It trades in a 52-week range of CA$0.39 and CA$0.185.

Sign up for our FREE newsletter

Important Disclosures:

- Defense Metals Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.