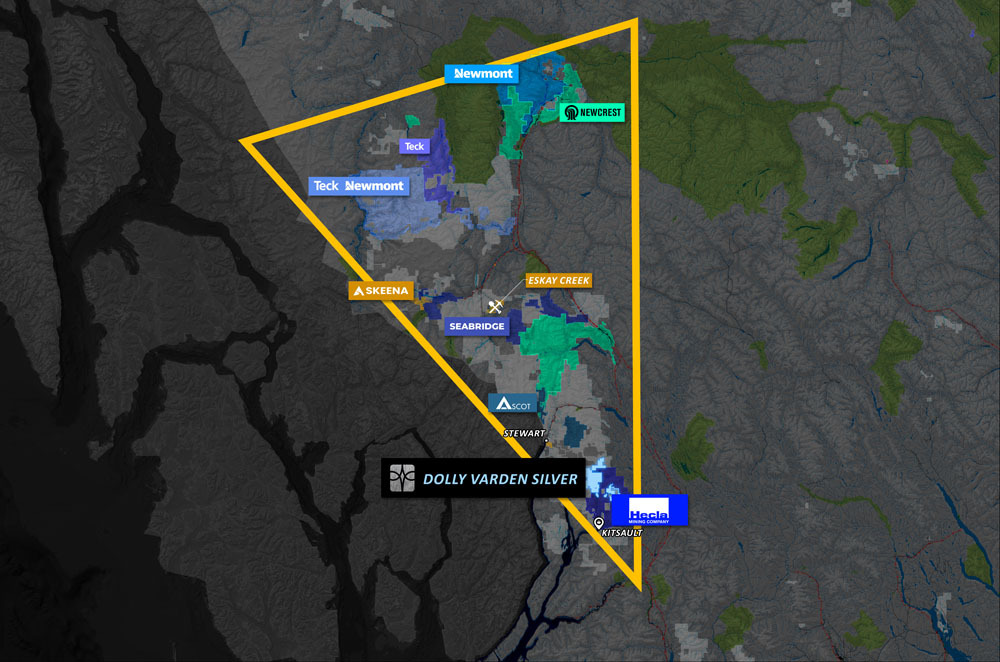

Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX) announced its 2023 exploration plans at its flagship Kitsault Valley Project in British Columbia's Golden Triangle as it works toward gauging the size of its mineralized system and growing the resources to be incorporated in an updated mineral resource estimate.

The company is mobilizing five rigs to drill 40,000 to 45,000 meters at the massive project, which comprises the Homestake Ridge and Dolly Varden properties.

Dolly Varden is "connecting the dots" on the property, newsletter writer Rick Mills of Ahead of the Herd wrote.

"It will be interesting to see how Dolly Varden can improve its understanding of the project and geological structures," he wrote. "The company is in a strong position to execute its 2023 field program. … The Dolly Varden (property) is one of only a few pure-play silver districts in the world."

The Kitsault Valley project hosts an indicated resource of 34.7 million ounces silver (Moz Ag) and 166,000 ounces gold (Au), and inferred resources of 29.3 Moz Ag and 817,000 ounces Au within multiple outcropping deposits.

Recently released drilling results revealed the highest-grade silver assay yet received from the Dolly Varden property.

Hole DV22-329 in the Wolf Vein northeast returned 1,499 grams per tonne (g/t) Ag, 1.8% lead (Pb), and 0.46% zinc (Zn) over 15.94 meters (8.77 meters estimated true width), including 23,997 g/t Ag, 1.24% Pb, and 0.34% Zn over 0.35 meters (0.19 meters estimated true width).

Dolly Varden is "connecting the dots" on the property, newsletter writer Rick Mills of Ahead of the Herd wrote.

Bob Moriarty of 321 Gold called Dolly Varden's assay results "absolutely staggering" and called the Golden Triangle "one of the most important districts in the world."

"Dolly Varden has done an incredible job," Moriarty said. "Anyone interested in investing should go to their website and go through the news because the numbers are absolutely mind-bending."

Technical analyst Clive Maund of CliveMaund.com noted in March it was "an excellent point to add to positions in Dolly Varden or make fresh purchases."

Research Capital Corp. analyst Stuart McDougall noted that Dolly Varden's drilling results were "generally supportive of each project's exploration upside" and reiterated his Speculative Buy rating for the stock with a CA$1.35 per share target.

The Catalyst: Creating Value With the Drill Bit

Dolly Varden said this year's exploration program would follow up success from last year with step out holes at the Wolf and Homestake Ridge deposits and exploration holes that will allow the inclusion of new mineralization drilling over the past three drilling programs in the updated resource estimate.

"We are continuing our successful strategy of expanding current resources while also testing new exploration targets for discovery," Dolly Varden President and Chief Executive Officer Shawn Khunkhun said. "The company has over (CA)$26 million in the treasury, positioning our exploration team with a tremendous opportunity to create value with the drill bit."

Bob Moriarty of 321 Gold called Dolly Varden's assay results "absolutely staggering" and called the Golden Triangle "one of the most important districts in the world."

The updated resource estimate will be the basis for a preliminary economic assessment (PEA) for the project.

Drilling at Dolly Varden's Wolf Vein will focus on infill drilling from wide-spaced intercepts from 2022 and step out holes in the southwest, north, and east where high-grade silver mineralization remains open. Hole DV22-329, which returned the 23,997 g/t Ag over 0.35 meters, is in that vein.

Similar step out drilling will follow up on high-grade silver mineralization at the Kitsol Vein, also in the Dolly Varden deposit.

Drilling at Homestake Ridge in 2023 will target the down-plunge extensions of higher-grade and wider zones of gold mineralization, such as 2022 hole HR22-333, which intersected 46.31 g/t Au, 70 g/t Ag, and 0.19% copper (Cu) over 25 meters, including 1,145 g/t Au, 826 g/t Ag, and 0.51% Cu over 0.48 meters.

Pure-Play Silver

Moriarty said he believed Dolly Varden could be another Eskay Creek, which has historically produced 160 Moz Ag and 3.3 Moz Au.

Most people aren't aware that 70% of the silver produced in the world is a byproduct of copper mining, he said.

"Dolly Varden is pure silver," Bob Moriarty said. "The number of pure silver mines in the world is small — only 30% total."

"Dolly Varden is pure silver," he said. "The number of pure silver mines in the world is small — only 30% total."

Silver is used to coat electrical contacts and is an important element in solar technology. Almost all computers, phones, cars, and appliances contain it.

Demand for the precious metal was predicted to reach a new high of 1.21 billion ounces in 2022, up 16% from the year before, according to the Silver Institute. Industrial demand, including vehicle electrification and other green technologies, was on course to grow to 539 Moz during that time.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCQX)

The institute said the global silver market is forecasted to record a second consecutive deficit between supply and demand this year. At 194 Moz, it will be a multi-decade high and four times 2021's level.

Ownership and Share Structure

Strategic investors own 43% of the company, including Fury Gold Mines Ltd. (FURY-T) with 23%, Hecla Mining Co. (HL:NYSE) with 10%, and mining financier Eric Sprott with 10%, according to the company. About 50% is institutional and the rest is retail.

The company is covered by several analysts, including Michael Gray of Agentis Capital, Geordie Mark of Haywood Securities, and McDougall with Research Capital Corp. Newsletter writers Maurice Jackson, The Critical Investor, Clive Maund, Rick Mills, and Bob Moriarty also follow the company. Click the bottom of the data box above to view more coverage.

Dolly Varden has a market cap of CA$282.29 million and 254 million shares outstanding, with 231 million shares free-floating, according to the company. It trades in a 52-week range of CA$1.24 and CA$0.355.

Sign up for our FREE newsletter

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Dolly Varden Silver Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Dolly Varden Silver Corp., a company mentioned in this article.